Built For How P&C Underwriters Actually Work

Sixfold learns your risk appetite, assesses submissions, and automates what comes next.

Underwriters' time is too valuable for hours of manual work.

Here's how Sixfold clears the admin and keeps underwriting moving:

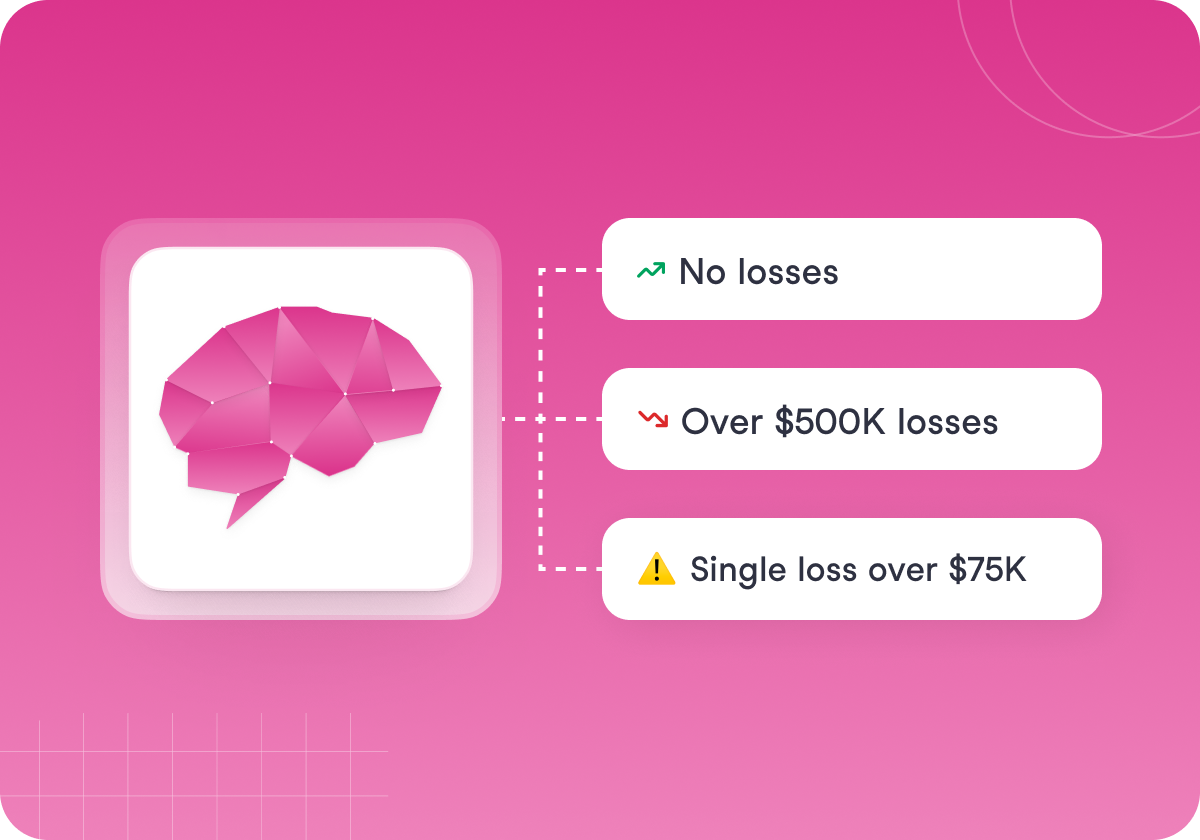

Understands Your Risk Appetite

Sixfold ingests your underwriting guidelines and learns your specific risk appetite—what to prioritize, what to flag, what matters most.

Underwriting brain tailored to your guidelines

Specific to each line of business you write

Easily update as risk appetite evolves

.png)

Analyzes Every Submission

Sixfold handles messy submissions as they come, no separate data extraction tools needed. Every submission gets read completely and assessed consistently against your appetite.

Ensures consistent guideline application

Surfaces risks buried deep in documents

Easy intake via direct upload, email forward, or API

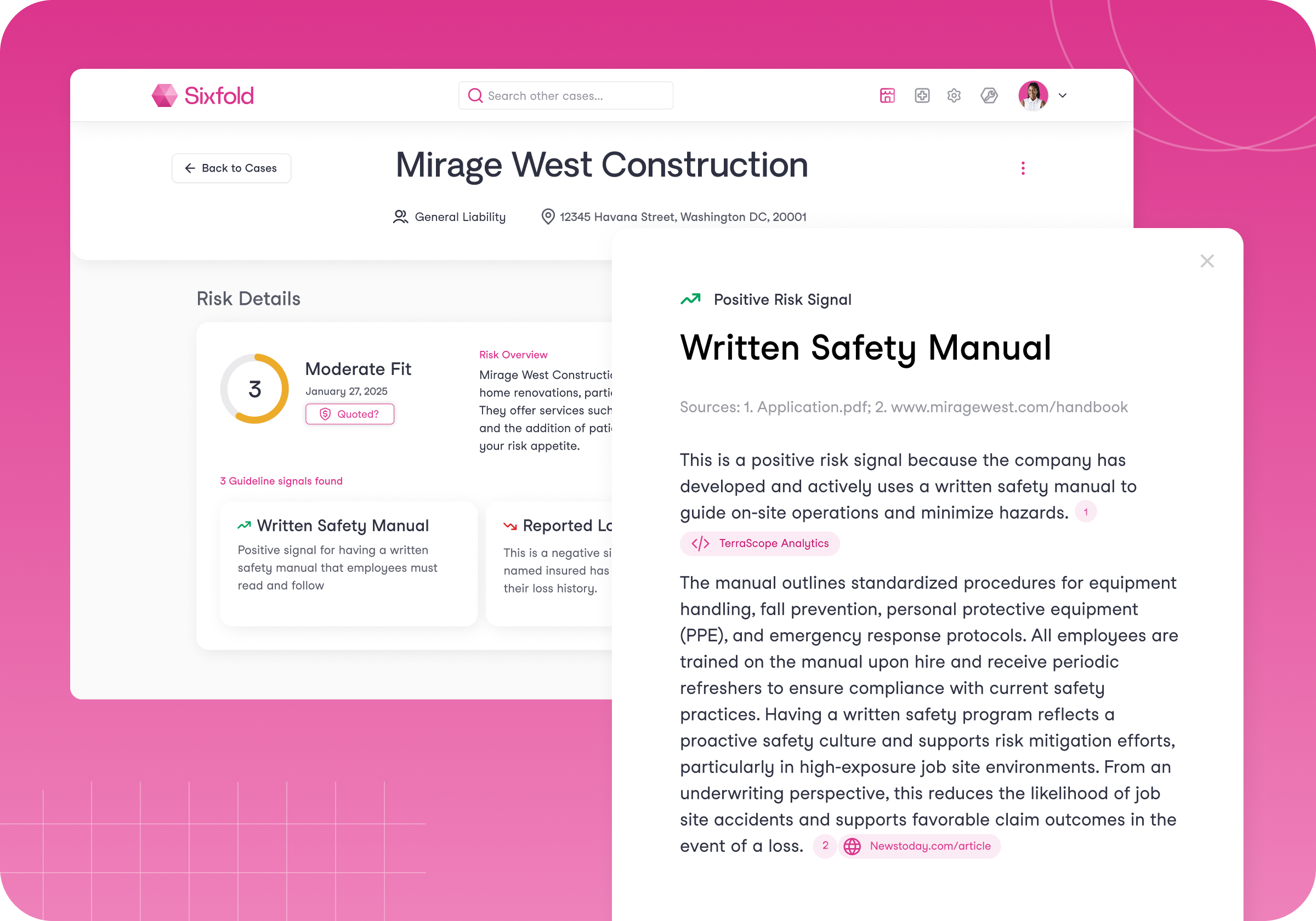

Surfaces What Matters Most

Sixfold surfaces appetite fit scores for quick triage, individual signals that explain the risks found and why they matter, and a full case narrative. All cited for easy verification and documentation.

Risk insights explained relative to your guidelines

Sources cited for easy verification and documentation

Flexible narrative format adapts to your workflow needs

.png)

Takes Action to Clear Bottlenecks

AI agents automate time-consuming tasks like research, referrals, and portfolio reviews so underwriters can focus on growth.

Pre-trained for common underwriting tasks

Deploy one agent or multiple

Agent outcomes displayed for human-in-the-loop

.png)

INTEGRATIONS

Works Wherever You Do

Use Sixfold standalone or our flexible API to integrate into your existing workbench, CRM, or policy admin system. Underwriters stay in familiar environments while AI works in the background.

Sixfold by the Numbers

1M+

submissions processed

40+

lines of business across P&C and L&H

50%

faster case reviews

30%

increase in premiums per underwriter

Some of our key capabilities

See why insurers love Sixfold

"Sixfold has become essential to our underwriting operations. We've gone from testing it to requiring it’s input for every quote."

Matthew Richardson

Global Head of Operations & IT @Generali GC&C

"Sixfold delivers insights to make fast and confident decisions, driving better engagement with brokers and customers"

Kristof Terryn

Chief Executive Officer @Zurich North America

"Sixfold enhances underwriting insight, consistency, speed of analysis and response"

Andrew Robinson

Chairman & CEO @Skyward Specialty

.png)