Operations run on Sixfold. Strategy runs on people.

Sixfold is the AI brain that handles the heavy lifting in submissions, empowering underwriters to build more profitable portfolios.

TRUSTED BY LEADING INSURERS

"Sixfold has become essential to our underwriting operations. We've gone from testing it to requiring it’s input for every quote."

.avif)

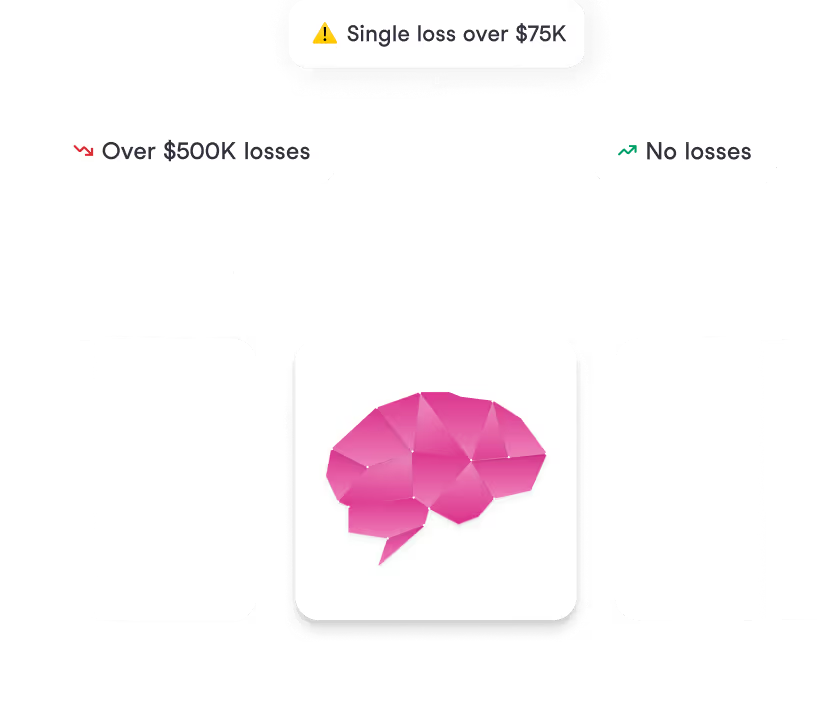

How The AI Brain Works

Learns Your Risk Appetite

Sixfold ingests underwriting guidelines in a secure, isolated environment - you’ve got full control of your data.

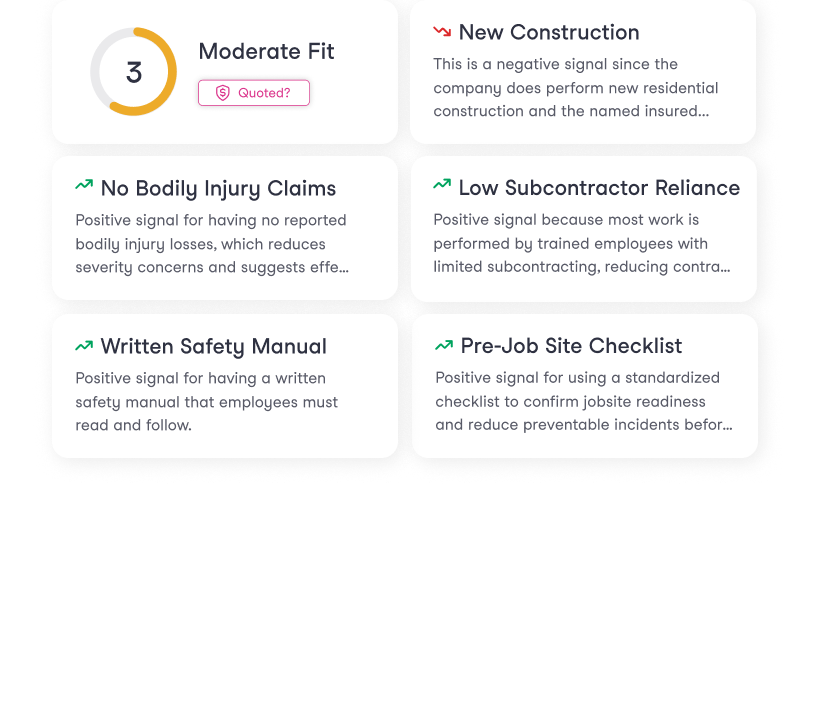

Assesses Every Submission

AI agents triage cases, surface risk insights, and cite sources so underwriters know exactly where information comes from.

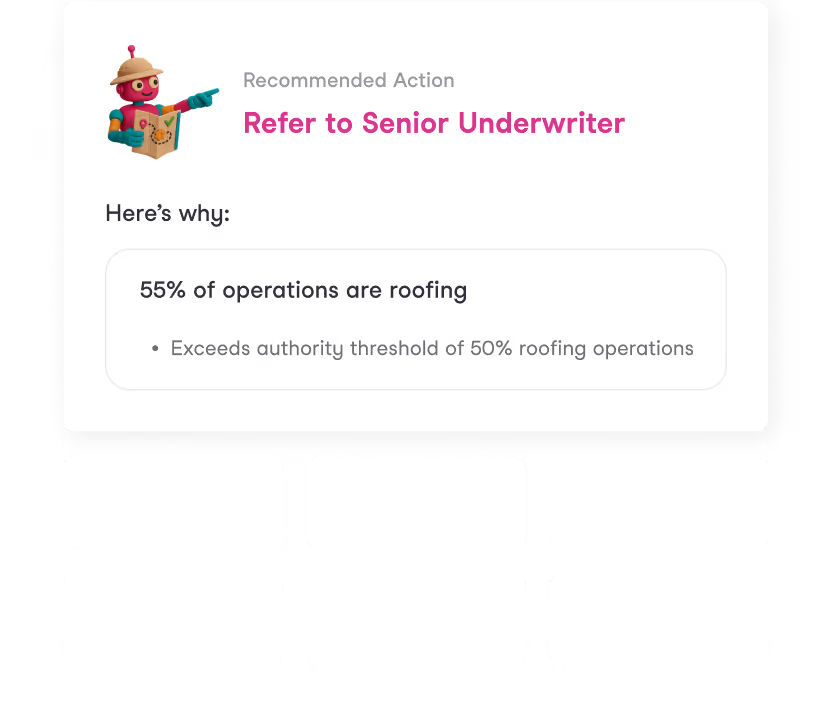

Takes Action

Agents don't just analyze, they research, write referrals, update documentation, and move cases forward autonomously.

From GL to Cyber to Life & Beyond

How Market Leaders Underwrite

Results You’ll See

50% Improved Efficiency

Underwriters reach decisions faster by spending less time on manual work.

45% Faster Onboarding

New underwriters get up to speed in weeks, with consistent guidance from day one.

30% More GWP per Underwriter

Underwriters process more submissions and select better risks.

Built on Strong Foundations

Responsible AI Framework

We maintain strict data governance with customer data isolation and security. As AI regulation evolves, we're proactive about compliance, model documentation, and bias monitoring.

.svg)

.avif)

.png)