Sixfold Content

Sixfold News

AI Adoption Guide for Underwriting Teams

Over the past few years, we've worked with more than 50 underwriting teams to bring AI into their day-to-day operations. So we've put together a 5-stage guide that covers what successful AI adoption actually looks like, from picking the right starting point to building trust and scaling across your team.

.png)

Stay informed, gain insights, and elevate your understanding of AI's role in the insurance industry with our comprehensive collection of articles, guides, and more.

New Features to Revolutionize Life & Disability Underwriting

Our latest Life and Disability AI-powered features focus on overcoming longstanding underwriting challenges and gives a fresh perspective to underwriters.

With our latest product update, we’ve sharpened our focus on Life & Disability via a suite of AI-powered features that overcome common underwriting challenges.

Sixfold’s number one superpower is to easily–and quickly–ingest carriers’ unique underwriting guidelines and automatically surface the submissions that match the carrier’s unique risk appetite. Moreover, the platform empowers Life & Disability carriers to streamline the underwriting process by:

🔘 Ingesting data from multiple disparate sources in an instant

🔘 Generating a comprehensive summarization of the applicant's health history and lifestyle within minutes

🔘 Surfacing positive & negative risk signals aligning with the unique risk appetite of each carrier

🔘 Triaging submissions with an underwriter-facing dashboard for improved resource allocation

We've significantly broadened our Life & Disability offerings by expanding into six key areas, facilitating us to quickly create a comprehensive 360-degree applicant profile in just minutes by:

✔️ Reducing manual workload through improved document ingestion

Our technology has been significantly enhanced to process and analyze an extensive history of lab results, diagnoses, and medication records, covering years or even decades.

The platform is proficient in ingesting data from various sources including APS files, MIB reports, labs, applications, supplementals, Electronic Health Records (EHR), and Fast Healthcare Interoperability Resources (FHIR) files. By automating the ingestion of these diverse data types, Sixfold eliminates the need for manual document handling by underwriters.

✔️ Refining risk evaluation with a holistic view of medications, treatments, lifestyle choices, and family history

The platform leverages advanced synthesis of adjacent applicant history information, including pertinent family medical histories and lifestyle attributes, to offer a comprehensive understanding of their broader health habits and disease predispositions.

By integrating details from submitted records—such as family diagnoses ("father was diagnosed with melanoma at 63, but was successfully treated")—with insights into exercise routines ("engages in moderate-intensity aerobic exercise and weight lifting"), hobbies ("applicant scuba dives several times per year"), and substance use ("consumes a few beers every few days"), Sixfold provides a holistic view of an applicant's health.

This comprehensive approach enhances the precision of assessments, enabling more informed decisions regarding risk.

✔️ Improving risk decision precision with in-depth analysis of health condition progression

We are now able to aggregate data related to a condition, including adjacent factors like medication, to chronologically track the comprehensive progression of the condition across multiple data sources. By utilizing detailed health data and its evolution over time, we enable more informed and accurate underwriting decisions.

This approach provides a unique layer of detail, incorporating crucial health information over time, allowing underwriters to quickly grasp risk with relevant context, thereby informing more precise rating and pricing.

✔️ Enhancing fraud detection by identifying inconsistencies across sources

Underwriters are tasked with synthesizing and managing a vast amount of information from lengthy documents, including Attending Physician Statements (APS), self-reported data, laboratory results, and more. An important aspect of analyzing these documents is to identify inconsistencies or discrepancies that could arise from oversight or fraud. Instead of solely relying on underwriters to detect irregularities across diverse documents, Sixfold proactively identifies and flags these discrepancies to the underwriter.

The platform's automated capability to identify problematic areas empowers underwriters to make informed decisions, leading to more accurate pricing of premiums and greater reliability of applicant information, safeguarding both insurers and applicants.

✔️ Expanding traceability with full document and page number sourcing

Our recent achievement of SOC 2 Type 2 certification underscores our commitment to being a responsible AI solution.

In this release, we've taken traceability to the next level by ensuring underwriters have access to complete information sourcing, pinpointing the exact document and page for increased transparency and accuracy.

✔️ Boosting underwriting capacity with upgraded triaging functionality

Sixfold's latest update introduces a streamlined dashboard experience, designed specifically to empower underwriters to efficiently prioritize applicants who meet their risk tolerance and gracefully set aside those who do not. This effectively addresses the common 'front door issue' in Life & Disability underwriting, which involves managing an overwhelming influx of submissions by automating the pre-processing of applications. Within minutes, Sixfold accurately identifies and aligns applicants with the carrier’s risk criteria, significantly easing the burden of manual sorting and enabling underwriters to focus on the most suitable cases.

Our newest updates equip life & disability underwriters with a complete, clear and accurate health snapshot for every applicant, pinpointing key data points without sacrificing our commitment to compliance and data privacy.

Curious to see it all live? 👉 Watch our 20-minute product demo.

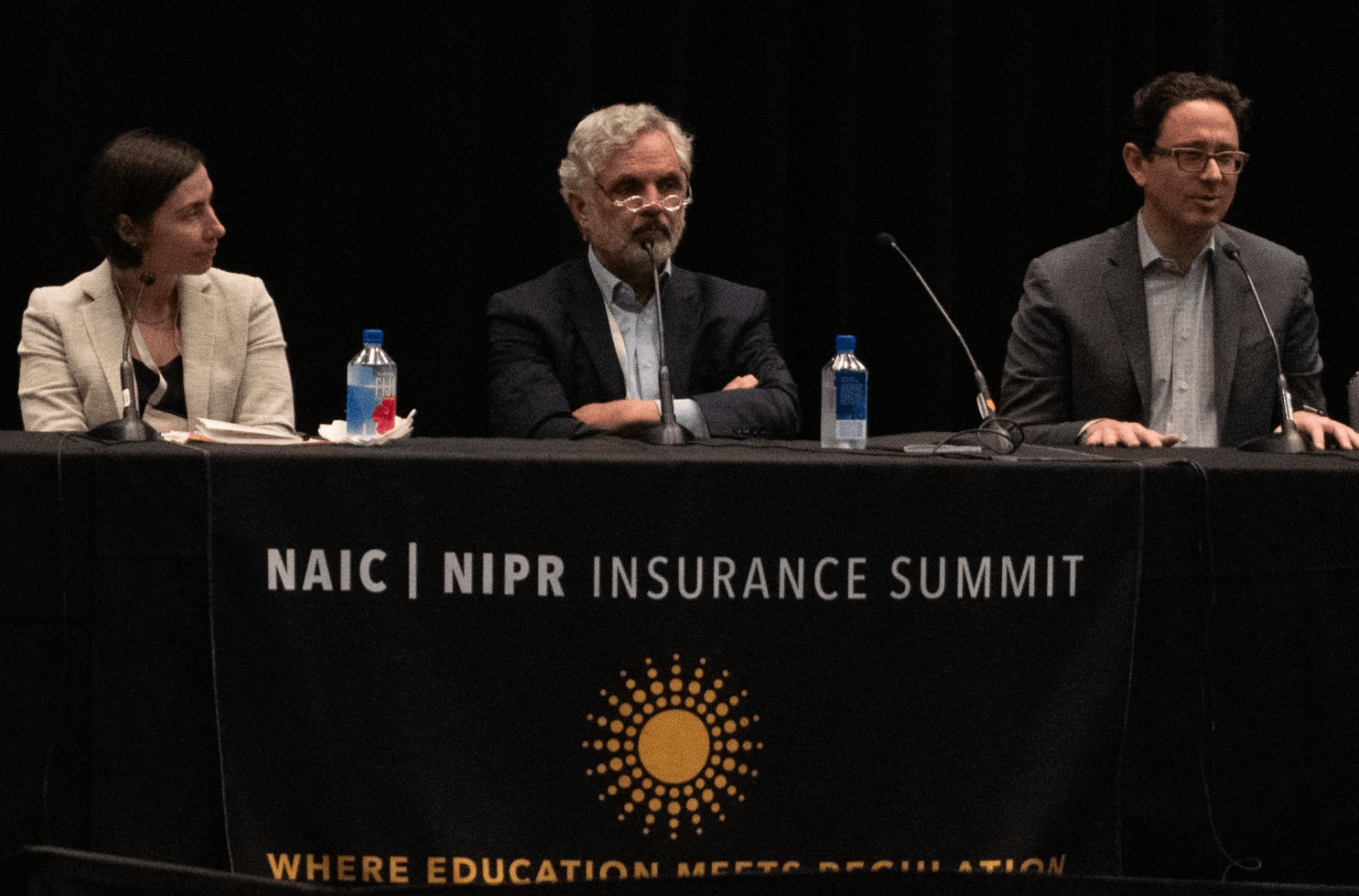

Navigating Unwritten Regulations: How We Did It

As regulators at all levels of government are drafting rules guiding the usage of artificial intelligence, Sixfold AI built a platform for unwritten rules.

AI is the defining technology of this decade. After years of unfulfilled promises from Hollywood and comic books, the science fiction AI future we’ve long been promised has finally become business reality.

We can already see AI following a familiar path through the marketplace similar to past disruptive technologies.

- Stage one: it’s embraced by early adopters before the general public even knows it exists;

- Stage two: cutting-edge startups tap these technologies to overcome long-standing business challenges; and then

- Stage three: regulators draft rules to guide its usage and mitigate negative impacts.

There should be no doubt that AI-powered insurtech has accelerated through the first two stages in near record time and is now entering stage three.

AI underwriting solutions, meet the rule-makers

The Colorado Department of Regulatory Agencies recently adopted regulations on AI applications and governance in life insurance. To be clear, Colorado isn’t an outlier, it’s a pioneer. Other states are following suit and crafting their own AI regulations, with federal-level AI rules beginning to take shape as well.

The early days of the regulatory phase can be tricky for businesses. Insurers are excited to adopt advanced AI into their underwriting tech stack, but wary of investing in platforms knowing that future rules may impact those investments.

We at Sixfold are very cognizant of this dichotomy: The ambition to innovate ahead, combined with the trepidation of going too far down the wrong path. That’s why we designed our platform in anticipation of these emerging rules.

We’ve met with state-level regulators on numerous occasions over the past year to understand their concerns and thought processes. These engagements have been invaluable for all parties as their input played a major role in guiding our platform’s development, while our technical insights influenced the formation of these emerging rules.

To simplify a very complex motion: regulators are concerned with bias in algorithms. There’s a tacit understanding that humans have inherent biases, which may be reflected in algorithms and applied at scale.

Most regulators we’ve engaged with agree that these very legitimate concerns about bias aren’t a reason to prohibit or even severely restrain AI, which brings enormous positives like accelerated underwriting cycles, reduced overhead, and increased objectivity–all of which ultimately benefit consumers. However, for AI to work for everyone, it must be partnered with transparency, traceability, and privacy. This is a message we at Sixfold have taken to heart.

In AI, it’s all about transparency

The past decade saw a plethora of algorithmic underwriting solutions with varying degrees of capabilities. Too often, these tools are “black boxes” that leave underwriters, brokers, and carriers unable to explain how decisions were arrived at. Opaque decision-making no longer meets the expectations of today’s consumers—or of regulators. That’s why we designed Sixfold with transparency at its core.

Customers accept automation as part of the modern digital landscape, but that acceptance comes with expectations. Our platform automatically surfaces relevant data points impacting its recommendations and presents them to underwriters via AI-generated plain-language summarizations, while carefully controlling for “hallucinations.” It provides full traceability of all inputs, as well as a full lineage of changes to the UW model, so carriers can explain why results diverged over time. These baked-in layers of transparency allow carriers–and the regulators overseeing them–to identify and mitigate incidental biases seeping into UW models.

Beyond prioritizing transparency, we‘ve designed a platform that elevates data security and privacy. All Sixfold customers operate within isolated, single-tenant environments, and end-user data is never persisted in the LLM-powered Gen AI layer so information remains protected and secure.

Even with platform features built in anticipation of external regulations, we understand that some internal compliance teams are cautious about integrating gen AI, a relatively new concept, into their tech stack. To help your internal stakeholders get there, Sixfold can be implemented with robust internal auditability and appropriate levels of human-in-the-loop-ness to ensure that every team is comfortable on the new technological frontier.

Want to learn more about how Sixfold works? Get in touch.

We at Sixfold believe regulators play a vital role in the marketplace by setting ground rules that protect consumers. As we see it, it’s not the technologist’s place to oppose or confront regulators; it’s to work together to ensure that technology works for everyone.