What is MCP - and Why It Matters for Underwriting

At Sixfold, we always integrate the latest AI advancements, but only when they truly help make underwriting faster, easier, and more accurate. One of the most promising technologies we’re exploring right now is Model Context Protocol, or MCP. Curious why? Read on.

What Is MCP?

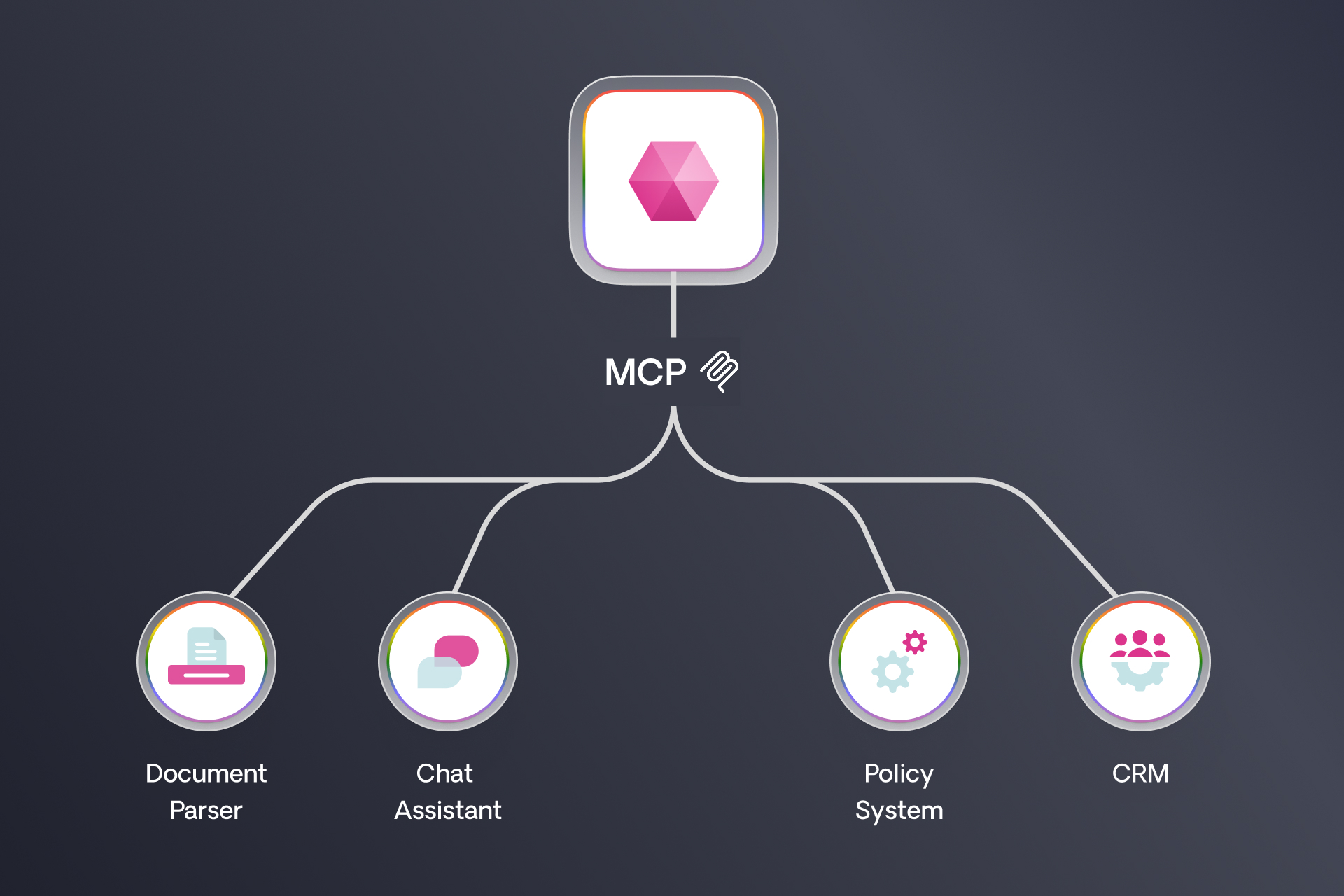

MCP is a way for different AI models, and the agents (read about agents here) that use them, to talk to each other.

Think of it like this: instead of manually connecting different systems when you want to share data, MCP lets one AI model pull context from another in real time, seamlessly and instantly.

Basically, instead of teaching every AI everything, you teach each one what it’s best at, and they learn to ask each other for help.

Who’s Behind It?

Since its introduction, MCP has gained traction among major AI providers:

Anthropic: The creator of MCP in November 2024, Anthropic has integrated the protocol into its Claude family of language models, enabling them to interact seamlessly with external systems.

OpenAI: In March 2025, OpenAI announced support for MCP across its Agents SDK and ChatGPT desktop applications, facilitating broader adoption of the protocol.

Google DeepMind: Shortly after OpenAI's announcement, Google DeepMind confirmed MCP support in its upcoming Gemini models and related infrastructure, highlighting the protocol's growing industry acceptance.

...and many more! It’s not just the AI giants. Tools like Linear, Zapier and Atlassian are jumping on board. Signaling that MCP is becoming foundational infrastructure, not just something for the leading LLMs, but for the everyday tools teams use to get work done.

MCP + Underwriting AI?

Why is MCP relevant for AI underwriting technologies? Today, many insurers have their own internal AI tools. MCP basically turns all these isolated AI models into a connected ecosystem.

Here’s an example:

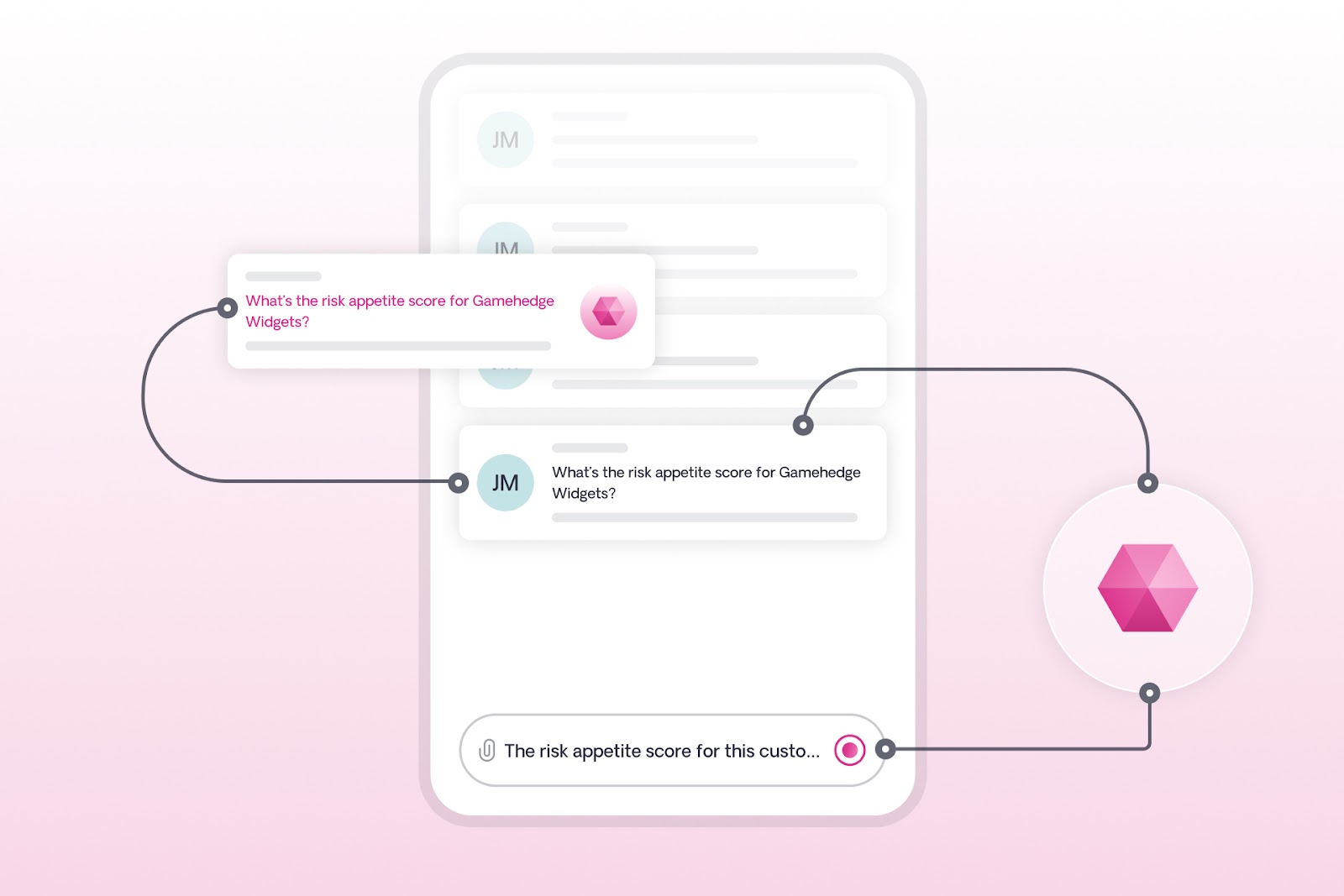

1. Let’s say a carrier has its own internal ChatGPT-like app as well as Sixfold's AI risk assessment solution.

2. With MCP, an underwriter using an internal chat tool, for example, can simply ask a question “What’s the risk appetite score for this customer named Gamehendge Widgets?”

3. Their AI doesn’t need to know everything itself, it just knows who to ask, in this case - Sixfold. It reaches out to Sixfold’s models, gets the answer, and serves it up directly to the underwriter.

No complex integration projects. No heavy lift for IT. MCP would act as a seamless bridge between Sixfold’s risk assessment expertise and the additional AI tools underwriters are using.

Why Sixfold Cares (a Lot)

Right now, almost everyone is talking about "agentic" behavior, how AI agents plan and reason independently. But the thing is that MCP is the quieter, more practical sibling: it’s about getting the right data in the right place, way faster than before.

The impact MCP can bring:

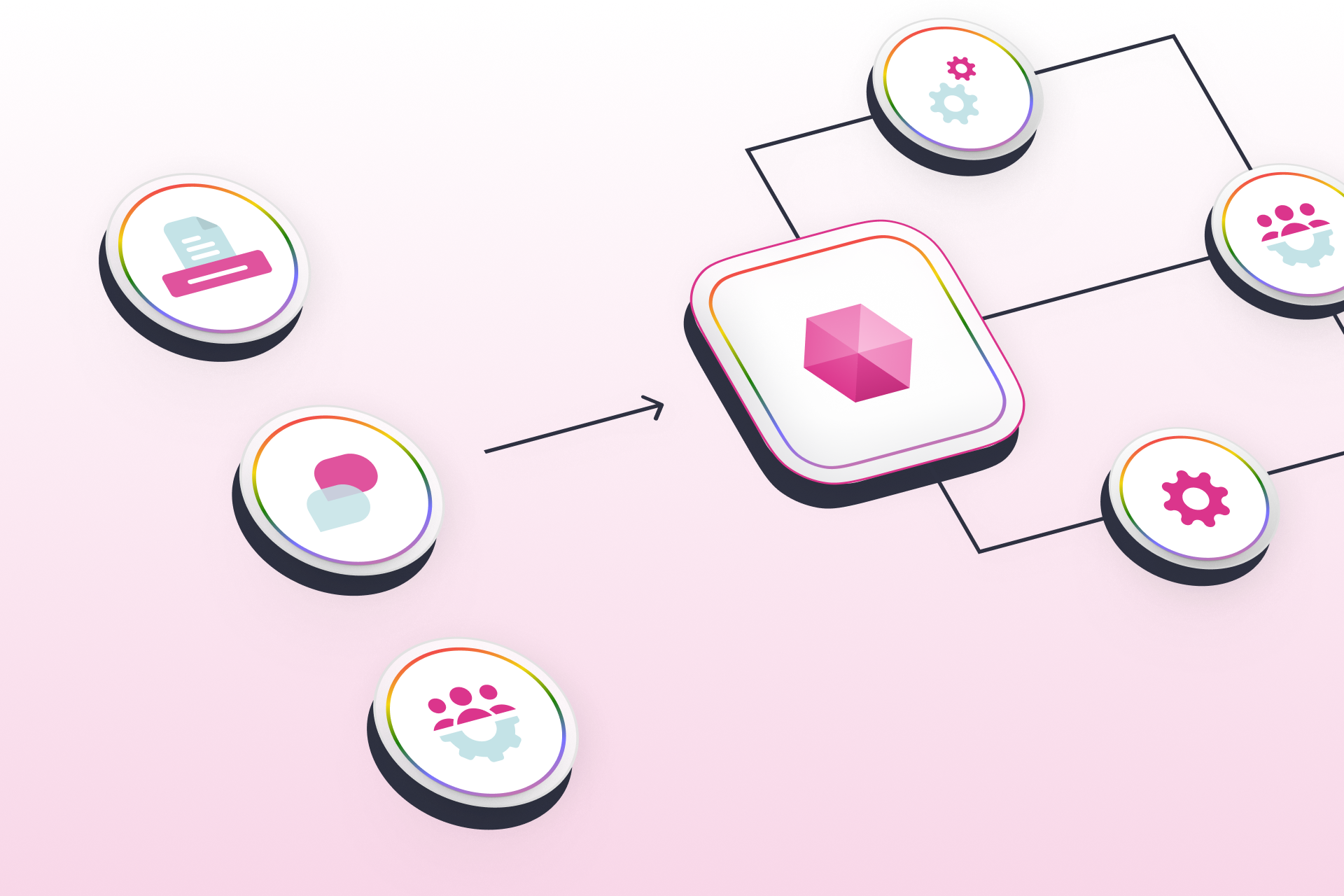

- It can meet underwriters where they are today - inside the tools they already use every day

- Enables flexible adoption where carriers can pull in just the capabilities they want, without a massive rollout

- It’s a leap forward in making underwriting AI more accessible and useful

At Sixfold, we’ve made MCP connections between our models and other systems, We’ve, and also exposed internal tools where AI chat assistants can query Sixfold’s underwriting insights.

What to Watch Out For

Like any new tech, MCP isn’t perfect. There are a few important risks to keep in mind:

Security:

- MCP is pretty quiet on the security mechanisms with which connected systems lock down their data. Existing enterprise-grade methods that companies like Sixfold use to protect sensitive customer data will need to be considered and implemented.

- Malicious tools could hide bad instructions if care is not taken on how different models talk to each other.

Accuracy:

- Incorrect or messy data leads to bad decisions. AI pulling data quickly doesn’t mean it’s always right, double-checking and validation are key.

What’s Next with MCP?

MCP done right (e.g. secure, validated and tested over and over) could be a kind of quiet but transformative technology that will make AI in insurance not just smarter, but more practical.

From many steps to one: MCP collapses complex processes into simple interactions.

From heavy integrations to light connections: Carriers can plug into any AI expertise easily.

From standalone tools to connected ecosystems: Underwriters get the best of all worlds, without even noticing the heavy lifting happening in the background.

Emerging protocol: Agent-to-Agent (A2A). A2A was launched by Google in April 2025 and has already gained support from Microsoft. The protocol addresses the need for AI agents, often developed on disparate platforms, to communicate and collaborate. Even with certain similarities, MCP and A2A work well together instead of competing. Google says that A2A is meant to go alongside Anthropic’s MCP.

As more organizations roll out MCP and A2A, AI assistants and agents are getting way better, more up-to-date, more capable, and way more useful in the flow of work.

The future of AI in underwriting isn’t just about smarter models, it’s about models that collaborate and talk to each other.