Referral Agent: From “To-Do” to “Done” in Seconds

Since AI’s introduction in underwriting, it has been about surfacing information: flagging risks, highlighting important insights, and providing recommendations. But there's always been a gap between AI that knows what needs to be done and AI that actually does it.

Sixfold's new Referral Agent closes that gap. It doesn't just spot problems, it solves them.

“We’re no longer just telling underwriters what to do, we’re helping them do it. This launch represents a major shift in how we drive efficiency and consistency in underwriting — turning “here's what you need to know’ into “here’s what we’ve already done about it”. The Referral Agent is just the beginning of that vision.”

- Alex Schmelkin, Founder and CEO of Sixfold

Where 40% of Cases Get Stuck

When we asked underwriters about their biggest workflow frustrations, referrals came up again and again.

Every underwriter knows this routine: you spot a case that needs escalation, and suddenly you're building a package. Pull the rules. Cross-reference submission details. Write a detailed email explaining your reasoning. Make sure the approver, such as senior underwriter, has everything they need to make a decision.

It's necessary work, but it takes about an hour per case. With up to 40% of applications requiring escalation, underwriters can spend half their day packaging referrals instead of evaluating risk.

The ripple effects hurt everyone. Brokers wait days for responses while referrals sit in approval queues. Approvers get packages missing key details and have to circle back with questions. What should be a quick handoff becomes a multi-day process that slows everyone down.

AI That Completes the Loop

Referral Agent transforms how this process works. Instead of stopping at identification that a case needs referral, it handles the next steps as well, freeing underwriters from manual reviewing the case so they can move the quote forward with confidence.

The underwriter's role shifts from package preparation to package review, freeing up time from admin work and letting them focus on more strategic decisions.

The repetitive process that used to take 60 minutes? It now takes 1 minute.

How it works

[Product video]

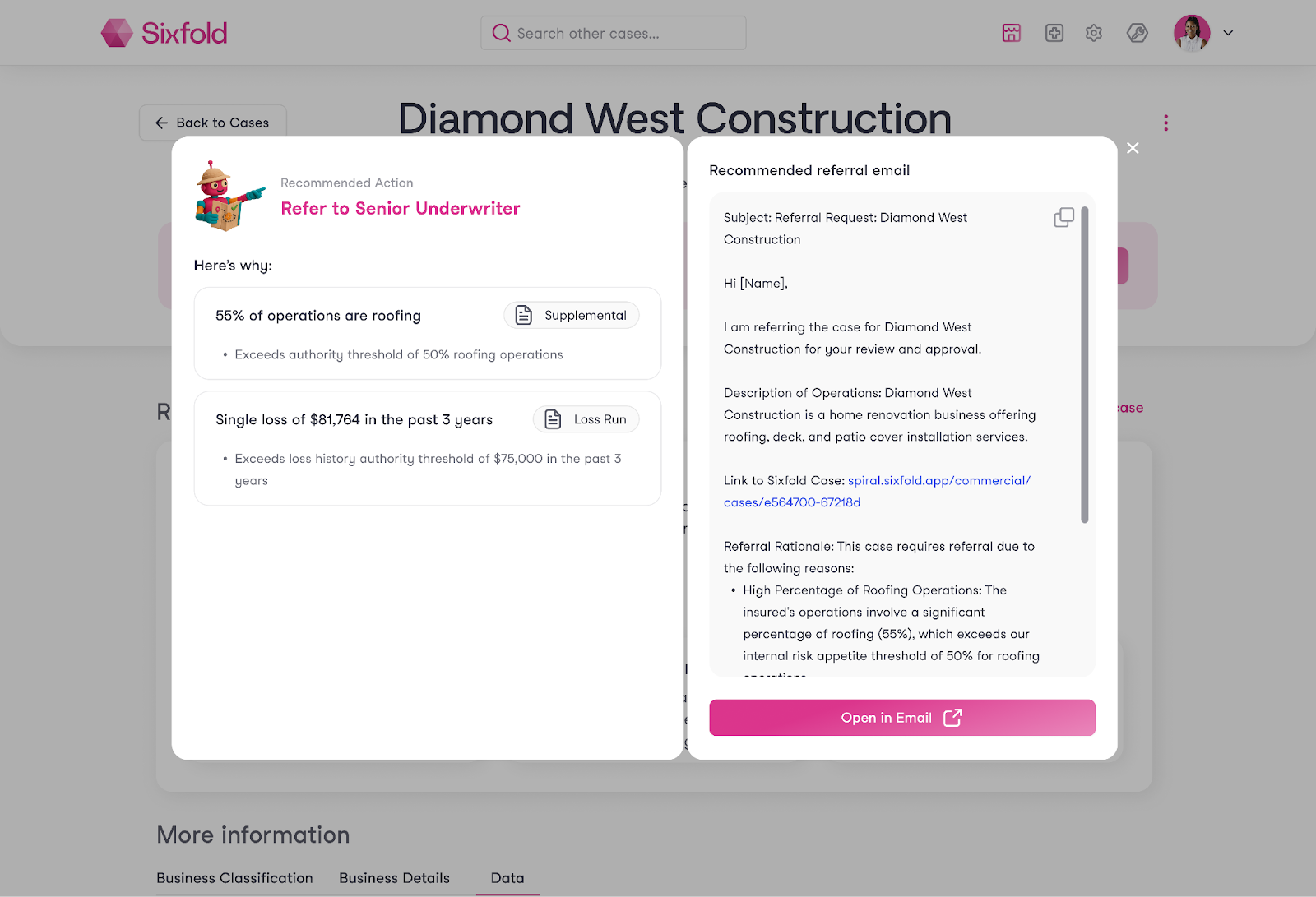

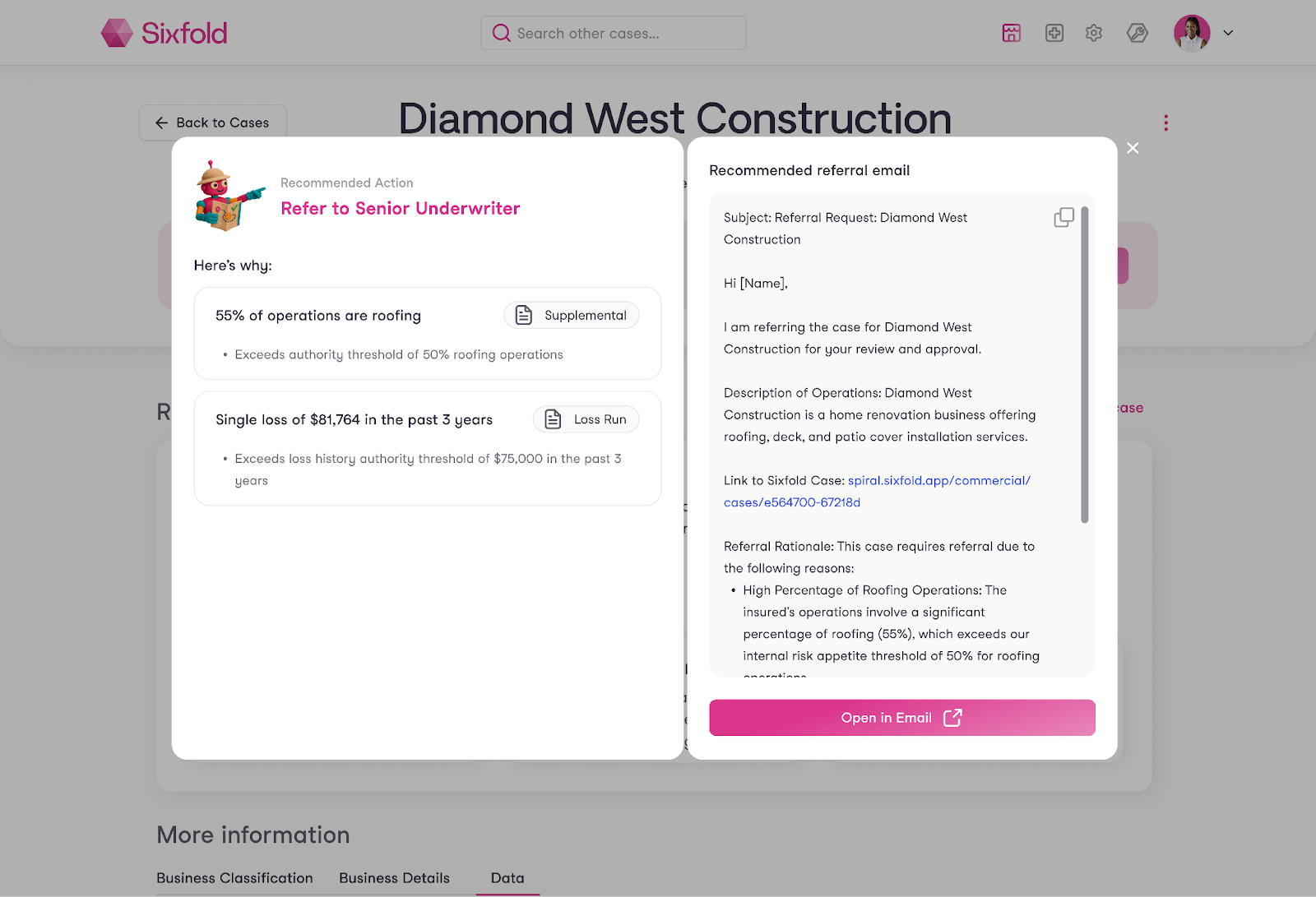

Sixfold understands the insurer’s unique risk appetite, applies what it’s learned, and clearly shows if and why a referral is required after case analysis is completed.

When the agent flags a case for escalation, it constructs a complete referral package in email form: business summary including the company's services and operational focus, case link that opens directly to the full underwriting analysis in Sixfold, and a structured rationale section that walks through each referral guideline breach step-by-step, citing the exact percentages, dollar amounts, and policy thresholds that might have triggered the referral requirement.

With this launch, we’re making the underwriter’s inbox part of the workflow. They can just forward a broker’s email, with attachments, straight to Sixfold, and the risk assessment kicks off automatically. When it’s time to refer, a pre-drafted email is done, ready to be sent with a single click from the underwriter’s default email provider. Insurers have the flexibility to fully automate this process or include a human-in-the-loop review by an underwriter before the email goes out.

Benefits by Role

For Referrers

- Always know when to refer

- No more repetitive referrals tasks

- Hours back every day for actual underwriting

For Approvers

- Every referral is standardized, making it easier to review

- With complete referral packages, you can decide faster - often same-day

- Automatic audit trail for compliance and training

For Insurers

- Referral guidelines applied consistently across every team

- Quotes out faster → happier brokers → improved hit ratios

- A process that scales with every underwriter hired

The Broader Vision

This marks the beginning of a full suite of AI agents built for execution, not just analysis. The