Sixfold Expands Underwriting Brain: AI to Research, Reason & Document

Over the past 2+ years, we've built an AI underwriting brain that evaluates risk based on each insurer's specific risk appetite, helping underwriters get better quotes out the door, faster.

Now we're expanding our capabilities with agentic research that provides deeper insights, intelligent risk synthesis that connects important patterns, and documentation that's actionable and audit-ready.

The result? Underwriting teams can operate at the speed their business demands, with the consistency and scale they need to stay competitive.

Underwriting AI: From Nice-to-Have to Business Critical

Commercial underwriting faces increasing complexity: rising costs from inflation and litigation, escalating risks from natural disasters and geopolitical instability, and mounting pressure from clients.

Meanwhile, 93% of business leaders believe companies that successfully deploy AI agents in the next 12 months will outpace their competitors¹. BCG identifies underwriting as the function where carriers will see the most measurable AI impact. The reason is clear: commercial underwriters spend hours daily on research, documentation, and repetitive tasks that AI handles expertly.

"Ask any underwriter how they spend their time, and they'll tell you: research and documentation.

Sixfold now cuts through those two major components so teams can get back to the work that matters: making decisions, nurturing broker relationships, and building their portfolio."

- Lana Jovanovic, Head of Product at Sixfold

What’s New?

Research Agent: Agentic Detective for Hidden Risk Data

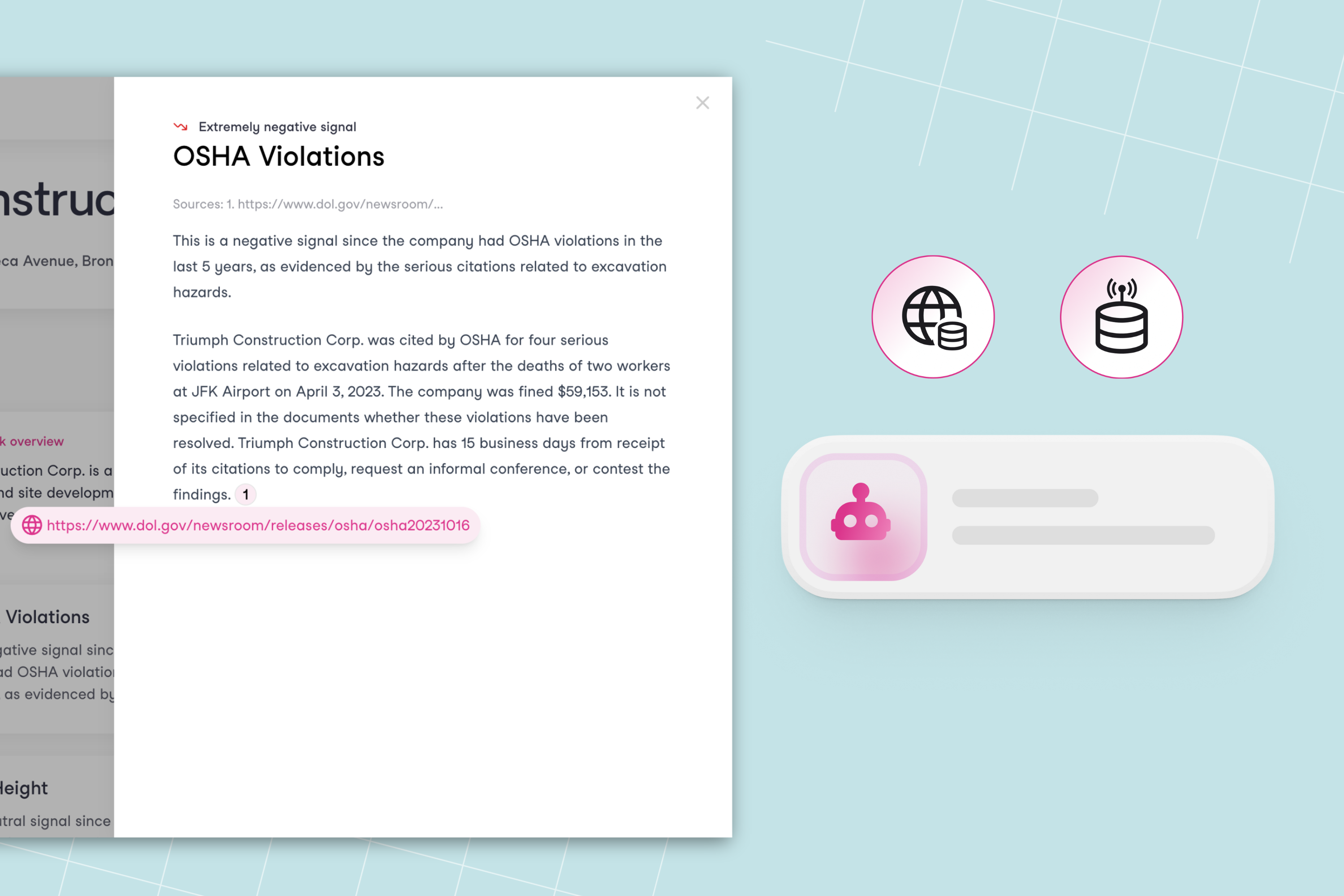

In commercial underwriting, submissions rarely contain everything underwriters need to properly assess risks. Critical information such as SEC filings, cyber incidents, litigation history, or executive misconduct aren't in the application, and finding that data falls on the underwriter.

The Research Agent does the external research work on the underwriter’s behalf. By filling critical information gaps and applying research from the public web and connected third-party data sources into Sixfold’s overall risk assessment, underwriters are given a complete risk picture for more precise appraisal.

The impact? Saving underwriters at least 2 hours per submission which means faster replies to brokers, increased quote volume, and more bound premiums.

Learn more about Research Agent here.

Narrative: Instant Case Notes That Fit Your Standards

Manual documentation drains productivity and invites inconsistency. With Narrative, Sixfold automatically generates case documentation aligned to your risk appetite, use case, and preferred format, whether for quoting, referrals, audits, or compliance.

The impact? Underwriters get clear, structured summaries to act on (and an average of 60 minutes time saved per case) and insurers gain consistent, audit-ready documentation.

Read more about Narrative, including the benefits the Zurich North America team has already seen.

Deep Thinker: The Heavy Lifter for Complex Risk

Risk assessment isn’t just about data, it’s about understanding. Deep Thinker enhances Sixfold’s core risk assessment brain with a specialized AI model designed for complex reasoning, numerical calculations and trend analysis, and deeper operational considerations.

The impact? Delivers more accurate and precise risk signals.

For example, Deep Thinker can flag concerning cybersecurity practices such as a company's outdated SSL certificates, accurately calculate key metrics such as a 30% rise in phishing claims, and explain its rationale and calculations in plain language. Feeding nuanced facts into the underwriting brain for risk signaling.

"These features hit every major pain point that underwriters deal with on a daily basis: manual research, inconsistent documentation, and complex risk analysis. Instead of spending hours on these tasks, Sixfold delivers it in minutes."

- Laurence Brouillette, Head of Customers & Partnerships at Sixfold

Benefits for Underwriters & Insurers

Get quotes out the door faster: Insurers typically average 8 days from submission to quote3—Sixfold can turn that into hours, helping carriers beat out competitors and win more business.

Standardization built right in: 70% of insurers cite inconsistent underwriting decisions as a core problem4. The combined power of Sixfold’s AI risk assessment, advanced risk appetite, and automated case documentation ensure consistent, scalable (and audit-ready!) underwriting across individuals and teams.

Moving beyond the back office: By eliminating manual research and documentation tasks, Sixfold gives underwriters more quoting capacity, plus the time and mental bandwidth back for thoughtful judgements, broker relationships, and portfolio building.

To learn how Sixfold can help your underwriting team scale, schedule a demo.