Sixfold Content

Sixfold News

AI Adoption Guide for Underwriting Teams

Over the past few years, we've worked with more than 50 underwriting teams to bring AI into their day-to-day operations. So we've put together a 5-stage guide that covers what successful AI adoption actually looks like, from picking the right starting point to building trust and scaling across your team.

.png)

Stay informed, gain insights, and elevate your understanding of AI's role in the insurance industry with our comprehensive collection of articles, guides, and more.

%20(1500%20x%201000%20px)%20(680%20x%20520%20px).png)

2024 Reel: Sixfold’s Biggest Product Wins And How We Built Them

To close out the year, we sat down with our engineering and product teams for a behind-the-scenes look at what we’ve built. The result? 9 key product achievements.

In case you’re new here, we’ll start by reintroducing ourselves. Sixfold is the first purpose-built AI for insurance underwriting, designed to help insurance underwriters reduce their manual workload. We work with global and innovative insurance carriers like AXIS, Zurich Insurance Group, and Generali.

This year has been full of milestones—we’ve processed over 150,000 submissions, responded to more than 250,000 custom underwriting queries, and gathered 3,200+ hours of underwriter feedback.

So, how did we get here? We sat down with our engineering and product teams to give you an inside look at what we built, how we did it, and the technology behind it all.

The result? Nine of our top product achievements this year, picked by the folks who built them from the ground up, all focused on improving accuracy, efficiency, and transparency for underwriters around the world.

1. Improved Accuracy through Advanced Data Extraction & Risk Matching

What is it? 💡

Accuracy is one of the key elements at Sixfold and this time we’ve improved our models to deliver:

- Better data extraction from complex insurance documents

- Faster and more accurate matching of insurer risk appetites to key signals within cases

How did we build this? ⚙️

Our AI team focused on these key areas:

- Addressing variability in LLM responses

- Developing accuracy metrics and ensuring targeted output

- Quantitative testing for basic accuracy

“Working with LLMs is unique because they don’t always give the same answer to the same question. To handle that variability, we created metrics to assess how well we extract the necessary information, the precision of our responses, and our performance on key tasks."

- Ian Cook, Head of AI

What’s the impact? 🚀

Boosting accuracy for underwriters is one of our core missions. With our latest models, we’ve seen a 40% improvement in data extraction accuracy compared to six months ago — even from the most difficult-to-read documents.

“General methods to pull text from a PDF don’t go far enough to meet the rigor we demand. By focusing on the specific documents and information underwriters need, we deliver a more targeted, efficient system than off-the-shelf data extraction services.”

- Ian Cook, Head of AI

2. Transparency in One Click Through

In-line Citations

What is it? 💡

With this feature, underwriters can find the source of any information Sixfold is showcasing –with just one click. It’ll show which documents and websites the facts came from. Need to know the exact page? No problem we got you!

In-line citations don’t just build trust in our platform; they also give underwriters context on certain risks and provide full traceability for every piece of risk analysis.

“One of the most important things for an underwriter is not only seeing the pertinent risk signals or questionnaire responses we surface as part of the Sixfold risk analysis but also being able to dig deeper or understand the broader concept behind that information.”

- Lana Jovanovic , Head of Product

How did we build this? ⚙️

In simple terms, we associate each extracted fact with a page number to surface the most relevant information. So, what was the underwriting need behind this development?

- Building trust and confidence in the results

- To quickly locate information without having to read through many documents

“Certain information surfaced as part of that analysis may even trigger additional add-on questions or thoughts that they may have about it, so they can really rapidly be able to dig in further”

- Lana Jovanovic, Head of Product

What’s the impact? 🚀

We’re bringing transparency, speed, and confidence for underwriters—making it that much easier to make informed decisions.

3. Quicker Decisions With Reduced Case Processing Time

What is it? 💡

With our commitment to making underwriters' lives easier, this improvement was an absolute must! Our engineers rolled up their sleeves and worked hard to bring our case processing time down by 61%!

So, what happens during that processing time? Sixfold analyzes aggregated information, searches the web for publicly available information company data, and decides the right NAICS/SIC code classification.

How did we build this? ⚙️

“It started by reviewing our analysis pipeline step-by-step. We measured the processing time and the size of the data payload for each step of our pipeline to see where we could identify any bottlenecks.”

- Ian Hirschfeld, Senior Engineering Manager

Here are the steps we took:

- Broke large data processing tasks into smaller and faster units that could run concurrently

- Reconfigured the pipeline to allow multiple analysis steps to run in parallel

What’s the impact? 🚀

A 61% reduction in processing time—and hopefully, a lot more happy underwriters!

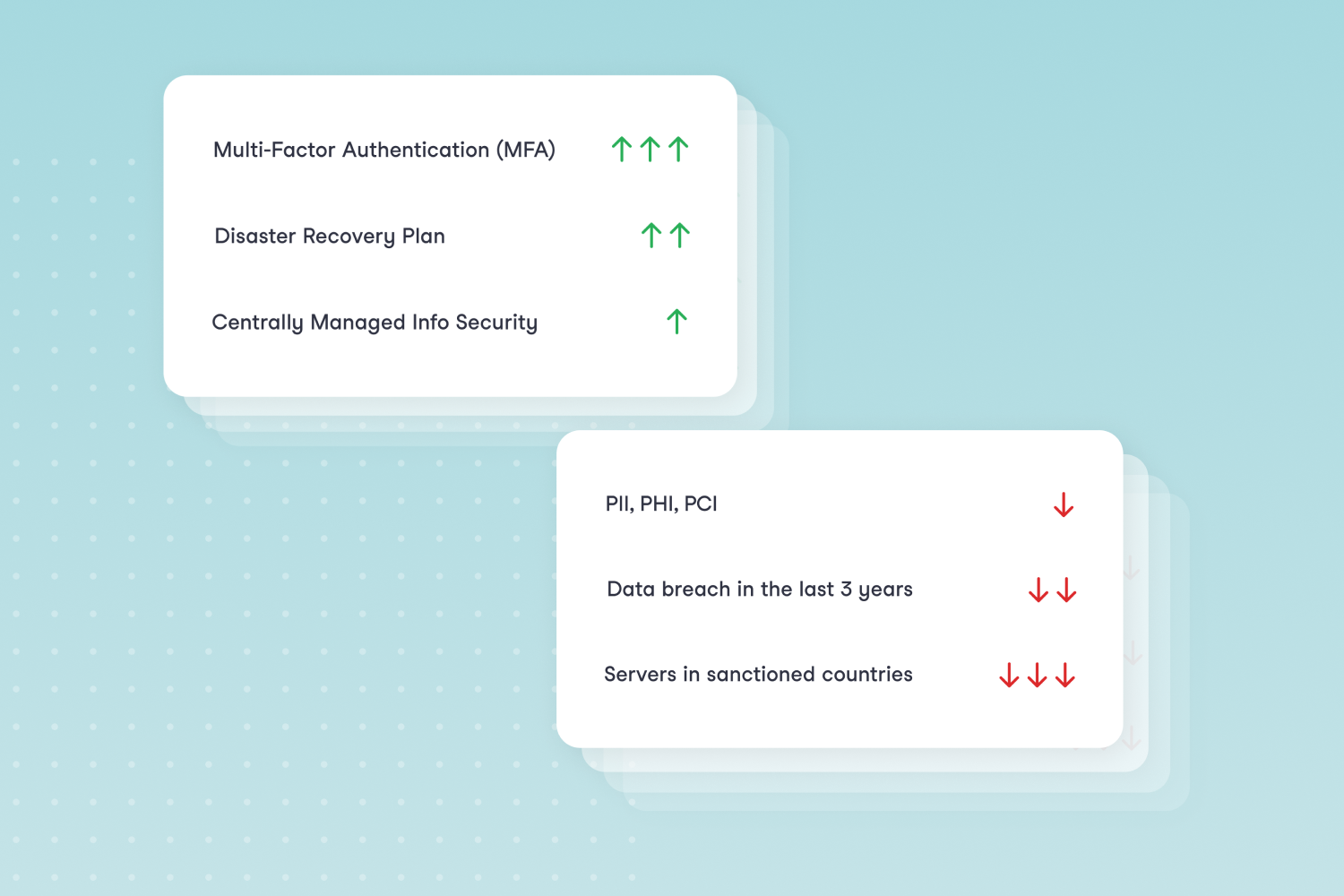

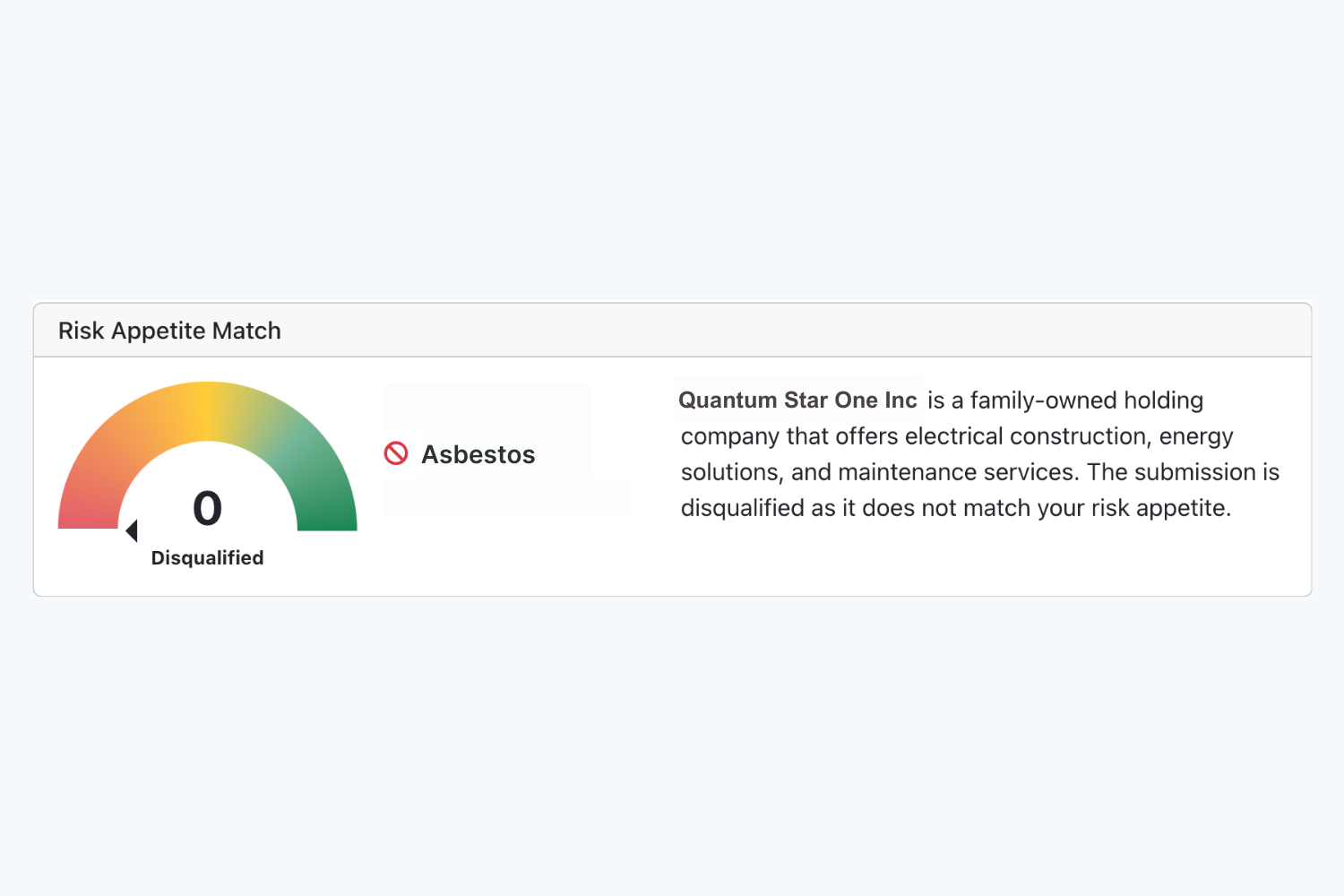

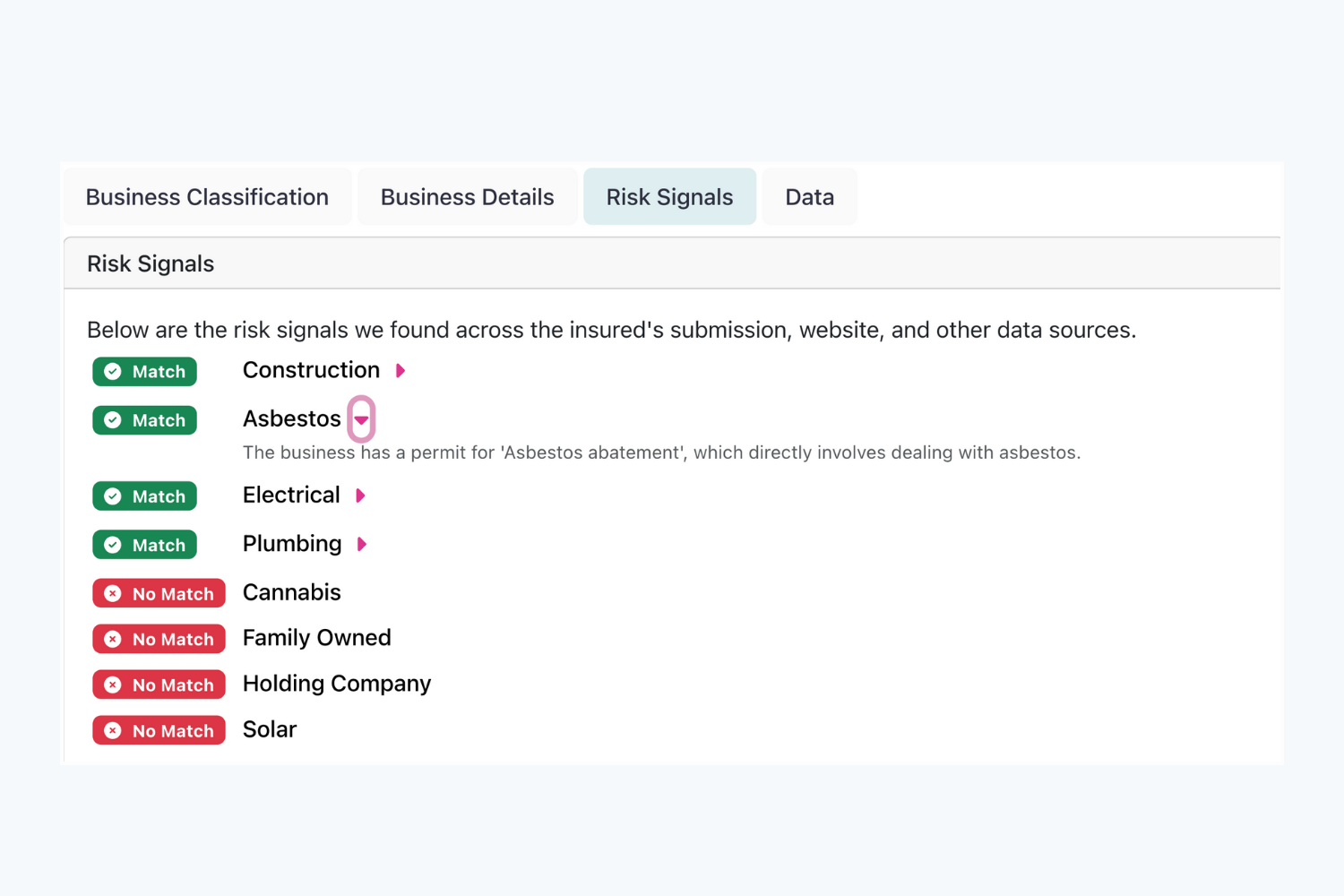

4. Closer Alignment With Your Risk Appetite Through Weighted Risk Signals

What is it? 💡

This feature will show underwriters all the risk criteria they’ve defined as important and classify those risks as either positive, really positive, negative, or really negative. And yes, the weighted risk signals are tailored to each customer’s unique risk guidelines and definitions.

For example, a cyber company might consider it a “really positive” signal if a prospect has implemented a Multi-Factor Authentication (MFA) process, while not having a backup in place might be something really negative.

How did we build this? ⚙️

Our product team envisioned this feature as something that could easily adapt to each carrier’s unique needs and got close support from our Lloyd's mentors during our 10-week Lloyd’s Lab Program, to refine and improve this feature.

Some of the core elements to figure out when building this feature included:

- Creating a scoring model that’s detailed enough to handle different signals without becoming too complex

- Balancing positive, negative, and neutral signals to accurately reflect real-world underwriting decisions

- Making sure the system could adapt smoothly to each carrier’s existing workflows

Because every carrier and industry interprets risk signals differently, we needed a solution that was both flexible and adaptable.

“The biggest challenge in designing this feature was addressing the diverse UW guidelines across various sectors.”

- Leonardo Momente, Senior Software Engineer

What’s the impact? 🚀

This feature is a great improvement in accuracy in appetite match scoring. This not only saves time but also improves underwriting precision.

“Frequent iteration and testing allowed us to refine the scoring criteria and user interface based on user feedback, ensuring the system was both effective and intuitive.”

- Leonardo Momente, Senior Software Engineer

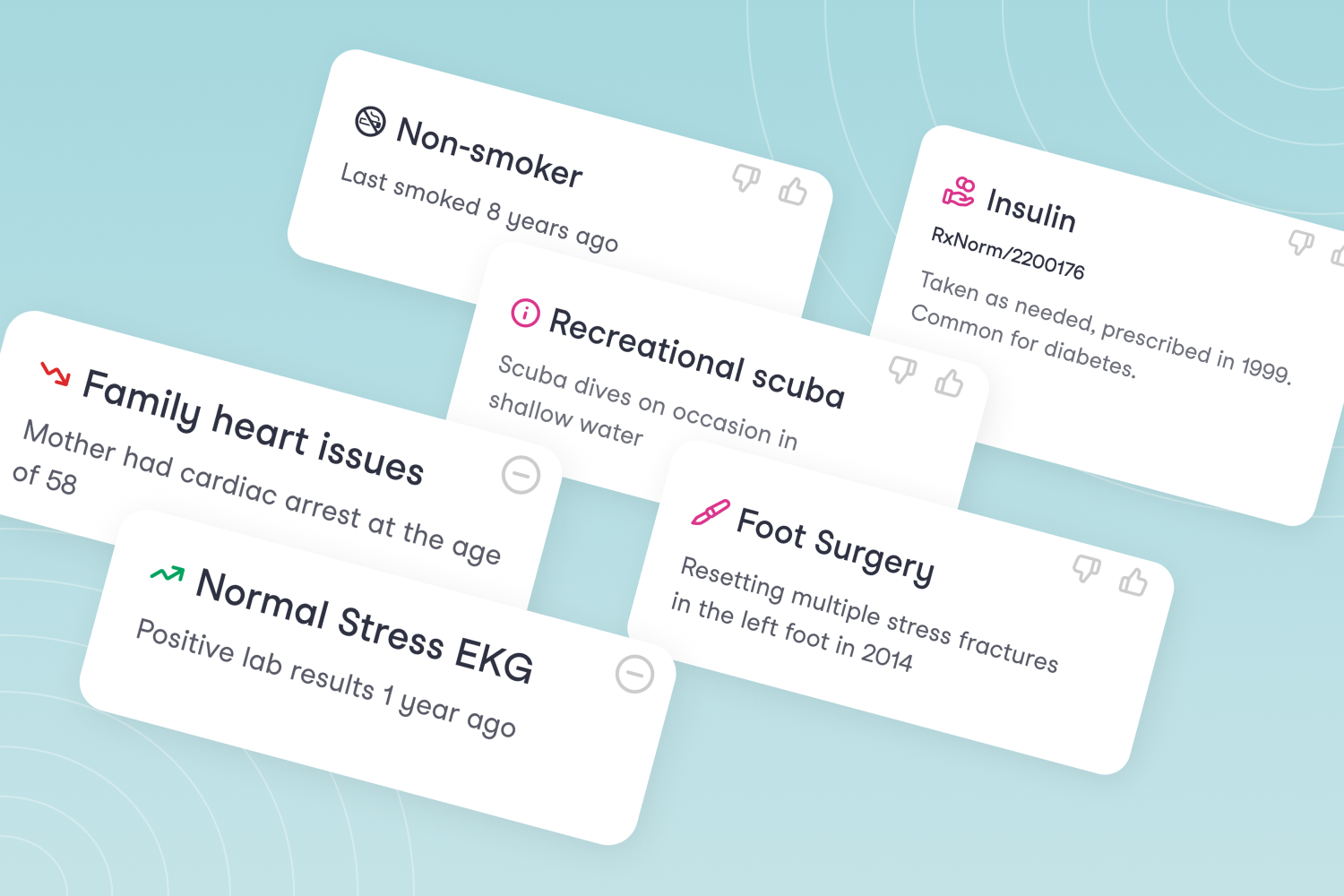

5. Reliable Evaluations Thanks to Detailed Medical & Lifestyle Insights

What is it? 💡

Life and disability underwriters have to go through hundreds of pages of medical documents, alongside lifestyle details, hobbies, and family medical histories. Sounds like a lot, right? Some might even compare it to detective work.

With our Life and Disability customers in mind, our product and engineering team built the Lifestyle & Medical History Analysis from scratch. This feature analyzes all the documents provided for a case and brings back a summary of all relevant risk information, helping underwriters quote cases more efficiently and quickly.

Sixfold takes care of the heavy lifting so that underwriters can focus on decision-making and relationship-building!

How did we build this? ⚙️

This feature was designed in different phases:

- Sixfold ingests all the documents underwriters upload for a particular case, extracting the relevant text from each file

- We analyze both the structured and unstructured data extracted, summarizing key information for the underwriter

- To make it even easier, we provide a chronological narrative of each case or condition

But, that’s not all! We also flag specific conditions predefined by the carrier and deduplicate repetitive information.

“One challenge was the fact that these medical histories can have a lot of repetitive information. For example, the history of a diagnosis or condition can appear many times across different types of documents.”

- Omeed Fallahi, Software Engineer

What’s the impact? 🚀

This feature dramatically reduces the manual work for underwriters, cutting down processing time for each case.

“You might have a negative risk signal for diabetes, for example. What the AI can do is identify a medication for diabetes that doesn’t explicitly mention the word ‘diabetes’ and flag it as a risk signal. This means the underwriter doesn’t have to constantly check what each medication is and what it treats.”

– Drew Das, Senior AI Engineer

6. Robust Security Through SOC2 Type II Certification + HIPAA Compliance

What is it? 💡

Our main goal is to make underwriters' lives easier – that’s at the core of everything we do – making sure our platform plays a huge part in that.

So, what does it mean for Sixfold to be SOC 2 compliant? This means that a neutral, expert third party has evaluated our platform to confirm we meet strict security controls, data protection, and availability standards. With SOC 2, we’ve gone the extra mile to prove these controls work consistently and effectively over time.

And what about HIPAA? HIPAA protects patient health information (PHI), and being HIPAA compliant means we’ve passed an audit confirming that our platform meets the privacy and security requirements needed to serve the life insurance industry.

How did we build this? ⚙️

Over several months, our engineering team addressed a series of steps to align with these regulations:

- Implementing strong access controls, user authentication, and data encryption

- Creating detailed incident response and disaster recovery plans

- Setting up continuous security monitoring, logging, and comprehensive documentation

"Team coordination and implementation proved to be a challenge. We needed to ensure all staff members were properly trained and fully understood our security protocols and compliance requirements. "

- Ryan Garver, Staff Software Engineer

What’s the impact? 🚀

By meeting these standards, we’ve put ourselves in a stronger position to help our customers meet their compliance needs in the insurance industry. It’s all about making Sixfold a trusted, reliable partner for carriers.

“For our platform, SOC 2 Type II and HIPAA compliance are fundamental business necessities, not just regulatory requirements”

- Ryan Garver, Staff Software Engineer

7. Establishing a Responsible AI Framework

What is it? 💡

We love helping underwriters improve their quoting process with AI—that’s our main goal—but we also want to do it in a responsible way and set the benchmark for Responsible AI. With that in mind, we created our Responsible AI Report.

The report gives an overview of Sixfold’s approach to safe AI usage and answers common questions about the topic.

With Sixfold, you can have peace of mind knowing that your data is:

- Never stored or used for training our base model

- Isolated and separated from others

- Locked up tight for ultimate security

How did we build this? ⚙️

Our AI team is constantly working on:

1. Evaluating and re-evaluating our workflows and pipelines

2. Reviewing data that enters our system and assessing it for appropriateness and consistency to ensure it aligns with our Responsible AI principles

3. Refining code, LLM-based interactions, and data governance to ensure no protected class information is inserted or surfaced

“While we always want to make sure we’re aligned with the latest research on Responsible AI, the principles themselves don’t change as often as the tools. Our focus is on applying those principles every time we evaluate new tools and techniques.”

— Ian Cook, Head of AI

What’s the impact? 🚀

The Responsible AI Report reinforces our security standards and compliance commitments, building trust with our customers.

“As someone once said, focus is choosing what not to do. The framework helps us keep focus by making it clear what we should not be doing.”

— Ian Cook, Head of AI

8. Boosting Speed and Accuracy with Fewer Tabs via API

What is it? 💡

You may not even notice, but you’re probably using APIs – Application Programming Interfaces –every day. An API allows different software to communicate while keeping the user on the same interface they’re familiar with. Think about online shopping—you don’t need to leave the site to process your payment through the credit card company, right? That’s an API working behind the scenes!

For Sixfold, launching our API was a big step because it brings simplicity and efficiency to underwriters using our system. Underwriting teams often work across multiple platforms during the quoting process, so we made it easy for our customers’ tech teams to integrate Sixfold’s AI capabilities directly into the tools they’re already using.

How did we build this? ⚙️

Our engineering team focused on:

- Identifying the most critical information to expose through the API and how this information might differ from what is presented in the Sixfold Web UI

- Highlighting the most relevant data, supported by auditable sources

- Minimizing exposure to behind-the-scenes complexity

What’s the impact? 🚀

Sixfold’s API makes it easier for our customers to process a high volume of cases daily.

“One of our customers submits approximately 1,000 cases per day, with an average processing time of 31 seconds per case.”

- Ian Hirschfeld, Senior Engineering Manager

9. Streamlining Workflow Efficiency with SSO Integration

What is it? 💡

Yes, SSO stands for Single Sign-On. But what does that actually mean? We like to think of it as a way to simplify the way users log into applications.

For our customers, that basically means using their corporate email address to securely access Sixfold’s platform. And trust us, implementing SSO isn’t easy—there are plenty of security considerations, and the first thing that comes to mind is compliance!

How did we build this? ⚙️

This feature was a top request from our customers and with a diverse client base, our platform team had a lot of boxes to check:

- Different configurations across different clients

- Which Identity Provider do they use? Microsoft Azure or PingFederate, for example?

- How does user authentication happen—and how do we map users correctly?

“If you have a team of different underwriters, maybe they have different permissions—maybe they can see one case that fits certain criteria but not another.

And when new underwriters join, you want them seamlessly authenticated and authorized the same way as your existing underwriters.”

- Mike Rooney, Principal Software Engineer

What’s the impact? 🚀

No more handling a bunch of passwords! SSO is simply a better way to log in, reducing the chance of leaked credentials.

“Very soon, we’ll just be able to send a link to new customers who want to set up SSO with us. They can go through a detailed onboarding guide at their own pace. Once they’re done and happy with the setup, it turns green on our dashboard and we’re good to go.”

– Mike Rooney, Principal Software Engineer

That’s a 2024 Wrap

Looking back at these product developments and improvements, a few key themes stand out— efficiency, accuracy, and transparency. These are the key elements Sixfold is committed to bringing to underwriters every step of the risk assessment process.

Want to see how we’re making a difference in underwriting today? Check out how AXIS reduced submission time from 30 minutes to just 60 seconds, and how Zurich’s underwriters saved an average of 90 minutes per submission.

Thanks for sticking with us until the end of this post, and we’ll see you in the next one!

.png)

AXIS Adopts Sixfold’s Purpose-Built AI Solution

Sixfold, the AI solution designed to streamline end-to-end risk assessments for underwriters, announced its partnership with AXIS, a global leader in specialty insurance and reinsurance, a collaboration that has yielded positive results in its initial roll out.

October 18, 2024 - Sixfold, the AI solution designed to streamline end-to-end risk assessments for underwriters, announced its partnership with AXIS, a global leader in specialty insurance and reinsurance, a collaboration that has yielded positive results in its initial rollout. Within the first month of deployment, AXIS underwriters leveraged Sixfold’s solution to improve efficiency, accurately classifying businesses and aligning cases with their risk appetite.

“This partnership is all about leveraging AI to empower our underwriters and even further enhance the service we provide to our customers. We were searching for a solution that could reliably deliver precision, and Sixfold has done just that and more.

The real game-changer has been the time savings—freeing up valuable hours so our underwriters can zero in on the work that drives results while ultimately benefiting the customer” said Josh Fishkind, Head of Innovation at AXIS.

“Our goal is to provide meaningful ROI for all our customers, and AXIS has already begun to see these benefits,” said Alex Schmelkin, Sixfold's Founder & CEO. “We look forward to continuing our partnership as AXIS discovers more ways Sixfold can enhance their underwriting processes.”

Read the full customer story here and check out the Insurance Post article covering our work with AXIS.

%20(1200%20x%20644%20px)%20(3).png)

Sixfold Partners with CyberCube

The partnership with CyberCube aligns with the strategy of utilizing the best data sources to streamline underwriting, keeping insurers ahead as cyber insurance premiums are projected to reach $20 billion by 2025.

In 2025, the cyber risk landscape is expected to become more complex with increasing threats driven by rising privacy violations, data breaches, the rise of AI, and external factors such as emerging regulations. According to Munich Re, the cyber insurance market has nearly tripled in size over the past five years, with global premiums projected to surpass $20 billion by 2025, up from nearly $15 billion in 2023, as reported by CyberSecurity Dive.

Reflecting the rapid market growth and emerging threats, Sixfold has seen increased demand from specialty insurers in the cyber sector and has successfully brought on several industry leaders as customers. "In the near future, cyber policies will become as essential as General Liability or Property & Casualty coverage. Given the world we live in, this shift is inevitable. Cyber policies are poised to become the most specific and highly customized policies available" said Jane Tran, Co-founder & COO at Sixfold.

"In the near future, cyber policies will become as essential as General Liability or Property & Casualty coverage. Given the world we live in, this shift is inevitable. Cyber policies are poised to become the most specific and highly customized policies available"

Empowering Underwriters to Quickly Adapt to New Cyber Risks

As cyber risks grow, the pressure on underwriters to assess risks accurately and expedite the case review process continues to increase. Sixfold’s AI solution for cyber insurance addresses these challenges by securely ingesting each insurer’s underwriting guidelines and aggregating all necessary business information to quickly provide recommendations that align with the carrier’s risk appetite. This capability allows insurers to quickly adjust their risk strategies in response to new cyber threats.

“With Sixfold, insurers can synchronize their underwriting guidelines across the board and adapt quickly. For example, when a new malware threat is identified, you can instantly incorporate it into your risk criteria through Sixfold. This ensures that the entire cyber team factors it into their assessments immediately without needing to learn every detail or the threat or spending hours digging for the right information” said Alex Schmelkin, Founder & CEO of Sixfold.

Besides, effective cyber underwriting demands deep expertise in IT systems, cybersecurity measures, and industry developments. This need for specific expertise presents a significant talent issue for insurers, especially with 50% of the underwriting workforce set to retire by 2028. Sixfold bridges the knowledge gap by instantly providing underwriters with the specialized knowledge they need for accurate risk assessments.

“Underwriters no longer need to be cyber experts; they can rely on Sixfold to spotlight the critical information needed for accurate underwriting decisions. Our platform simplifies the complex world of cyber risk and empowers underwriters to make more confident decisions, faster” said Jane Tran, Co-founder & COO at Sixfold.

Sixfold Partners with CyberCube to Enhance Cyber Risk Assessments

Sixfold has teamed up with CyberCube, the world’s leading analytics provider to quantify cyber risk. This integration of CyberCube's advanced cyber risk analytics with Sixfold's AI underwriting solution enables insurers to achieve faster and more accurate risk assessments. The partnership enhances underwriting efficiency, strengthens regulatory compliance, and offers highly tailored cyber insurance solutions, empowering insurers to stay ahead of the rapidly evolving cyber threat landscape. "The partnership between CyberCube’s comprehensive cyber data and Sixfold’s innovative risk assessment is setting a new standard for the future of underwriting, keeping insurers prepared for new challenges in determining accurate cyber policies.” said Ross Wirth, Head of Partnership and Ecosystem for CyberCube.

"The partnership between CyberCube’s comprehensive cyber data and Sixfold’s innovative risk assessment is setting a new standard for the future of underwriting, keeping insurers prepared for new challenges in determining accurate cyber policies.”

To see our Sixfold speeds up the cyber underwriting process join our upcoming live product demo.

New AI Features to Raise the Bar on Underwriting Efficiency

We’ve enhanced our commercial underwriting platform with a suite of AI-powered features that streamline end-to-end underwriting across all lines of business.

With our latest product updates, we’ve extended our commercial underwriting product with a suite of AI-powered features to facilitate end-to-end underwriting across all lines of business, scaling from transactional underwriting to complex, three-dimensional risks.

Sixfold’s number one superpower is to easily–and quickly–ingest carriers’ unique underwriting guidelines and automatically surface the submissions that match the carrier’s unique risk appetite. The platform empowers carriers to streamline the underwriting process by:

🔘 Analyzing publicly available information and ingesting data from multiple disparate sources in an instant for a comprehensive risk assessment

🔘 Generating a comprehensive summarization of the business’s operations and providing NAICS/SIC classification

🔘 Surfacing positive and negative risk factors tuned to a carrier’s unique appetite

🔘 Answering complex questions across large sets of documents

🔘 Prioritizing risks with an underwriter-facing dashboard for improved resource allocation

Over the past half, we’ve significantly matured our P&C underwriting platform with deep investments across accuracy, traceability, performance, and extensibility. Some of the key highlights include:

✔️ Improved Accuracy with Advanced Document Extraction

As underwriters ask complex questions across large sets of documents, we’ve invested in new models to improve extraction across the universe of insurance documents. With Sixfold’s latest models, we’ve seen a 40% boost in accuracy in extracting data from the most illegible documents.

With our ongoing investments in extraction models tailored to the documents underwriters see daily, Sixfold ensures precise and reliable insights from large, challenging document sets, transforming how underwriters interact with data.

.png)

✔️ Appetite Match Scoring with Weighted Risk Scoring

To replicate underwriters’ cognitive processes, Sixfold is introducing weighted risk signals to reflect the nuance across how underwriting factors impact where a risk sits within a carrier’s appetite. Now, carriers can assign varying importance to different factors to prioritize risks more accurately based on alignment with their risk appetite.

✔️ Enhanced Transparency with Inline Citations

Not only can Sixfold answer complex questionnaires across lines of business, but now all answers are grounded in the original source material with citations to the most relevant sections for confident decision-making.

✔️ Bringing Risk Classification and Summarization Down to Seconds

With our continued commitment to investing in the Sixfold pipeline architecture to improve performance, availability, and resilience, we’ve brought down the median case processing time from 80 seconds to 31 seconds. With these enhancements, in less than a minute, Sixfold can research publicly available information to learn everything we can about a business and analyze the aggregated data for business summarization and NAICS/SIC classification.

✔️ Embed Sixfold across Underwriters’ Existing Workflows with our API

With the Sixfold API, carriers can seamlessly integrate Sixfold into existing workflows for enhanced productivity and unified risk management. From automated data gathering and ingestion to custom-tailored underwriting recommendations that can be embedded across existing workflows and systems, Sixfold cuts out the manual work and document handling overhead for 10x faster risk review processes.

✔️ Mitigating drift and bias with our Responsible AI framework

Designed to navigate the rapidly evolving AI landscape confidently, Sixfold’s Responsible AI framework ensures carriers are well-insulated from risk with its enhanced auditability, data provenance, and traceability. By actively collaborating with regulatory bodies and legal counsel, Sixfold remains at the forefront of responsible AI innovation, safeguarding carriers with unparalleled diligence.

👀 Coming Soon: Research Assistant

Stay tuned for future launch updates to hear about upcoming capabilities like Sixfold’s Research Assistant, designed to find answers to complex research questions, all of which are grounded in the original source material with citations.

Want to see our new capabilities in action?

Get in touch →

It Takes You Months to Train AIs? You're Doing It Wrong

Discover the power of AI underwriting with Sixfold - the ultimate solution to overcome traditional limits and stay ahead in the insurance industry.

It’s impossible in 2024 to be an insurance carrier and not also be an AI company. In this most data-focused of sectors, the winners will be the organizations making the best use of emerging AI tech to amplify capacity and improve accuracy.

This is a challenge and opportunity that Sixfold is uniquely suited to address thanks to our decades of collective industry and technological experience. We know insurers’ needs—intimately—and understand precisely how AI can overcome them.

In previous posts, I’ve described how Sixfold uses state-of-the-art AI to ingest data from disparate sources, surface relevant information, and generate plain-language summarizations. Our platform, in effect, provides every underwriter with a virtual team of researchers and analysts who know exactly what’s needed to render a decision. But getting there is the rub. Training AI models (these “virtual teams”) to understand what information is relevant for specific product lines is no small task, but it’s where Sixfold excels.

To use AI is human, to create your own unique AI model is divine

Underwriting guidelines aren’t typically encapsulated in a single machine-readable document. They’re more likely to exist in an unordered web of internal documents and reflected in historic underwriting decisions. Distilling a diffuse cultural understanding into an AI model can take months using a traditional approach, but with Sixfold, it can be accomplished—and accomplished well—in as little as a few days.

Sixfold’s proprietary AI captures carriers’ unique risk appetite by ingesting a wide variety of inputs (be it a multi-hundred-page PDF of guidelines, a loose assortment of spreadsheets, or even past underwriting decisions) and translating it into an AI model that knows what information aligns with a positive risk signal, a negative one, or a disqualifying factor.

With this virtual wisdom model in place, the platform can identify and ingest relevant data from submitted documents, supplement with information from public and third-party data sources, and generate semantic summaries of factors supporting its conclusions—all adhering to the carriers’ unique underwriting approach.

Frees human underwriters to do uniquely human tasks

It can take years for a human underwriter to master underwriting guidelines and rules, but that doesn’t mean human underwriters are no longer needed–quite the opposite. By offloading the administrative bulk to AI, underwriters can use their increased capacity to prioritize cases that align with their unique risk appetite.

Consider a P&C carrier that prefers not to underwrite businesses that work with asbestos. When an application comes in, Sixfold’s platform processes all broker-submitted documents and supplements it with relevant data ingested from public and third-party data sources. If Sixfold were to then surface information about “assistance with obtaining asbestos abatement permits” from the applicant’s company website, it would automatically mark the finding as a negative risk signal (with clear sourcing and semantic explanation) in the underwriter-facing case dashboard. With Sixfold, underwriters can rapidly discern the applications that are incompatible with their underwriting criteria and quickly focus on cases aligned with their risk appetite.

Automating these previously resource-intensive data processing workflows allows carriers to obliterate traditional limits on underwriting capacity. The question for the industry has rapidly moved from “is automation possible?” to “how quickly can we get it implemented?” Sixfold’s purpose-built platform empowers customers to leapfrog competitors relying on traditional approaches to training AI underwriting models. We get you there faster–this is our superpower.

Sixfold Joins Guidewire Insurtech Vanguards Program

Explore the partnership between Sixfold and Guidewire's Insurtech Vanguards program, revolutionizing the industry with an AI-powered platform for underwriters.

New York City, January 9, 2024

Sixfold, the Generative AI exclusively built for insurance underwriters, today announced that the company has joined Guidewire’s Insurtech Vanguards program, an initiative led by property and casualty (P&C) cloud platform provider, Guidewire (NYSE: GWRE), to help insurers learn about the newest insurtechs and how to best leverage them.

Jane Tran, Co-founder & COO at Sixfold, expressed, “Guidewire stands as the industry's foremost policy vault, embodying the definitive source of truth. Collaborating with Guidewire empowers us to advance our enterprise-grade generative AI solutions tailored specifically for underwriters.”

Insurtech Vanguards is a community of select startups and technology providers that are bringing novel solutions to the P&C industry. As part of the program, Guidewire provides strategic guidance to and advocates for the participating insurtechs, while connecting them with Guidewire’s P&C customers.

Sixfold seamlessly handles the ingestion, routing, classification, and summarization of submissions, and provides trustworthy, data-driven policy recommendations to underwriters in a user-friendly format.

About Sixfold

Sixfold brings the power of generative AI to the underwriting process. The platform significantly reduces manual workload for underwriters and amplifies confidence in every underwriting decision with improved accuracy, transparency, and capacity.