Reliable results that tells the whole story

Sixfold doesn’t keep any secrets, full transparency is provided for all underwriting decisions. All In a manner that your compliance team will love tolerate.

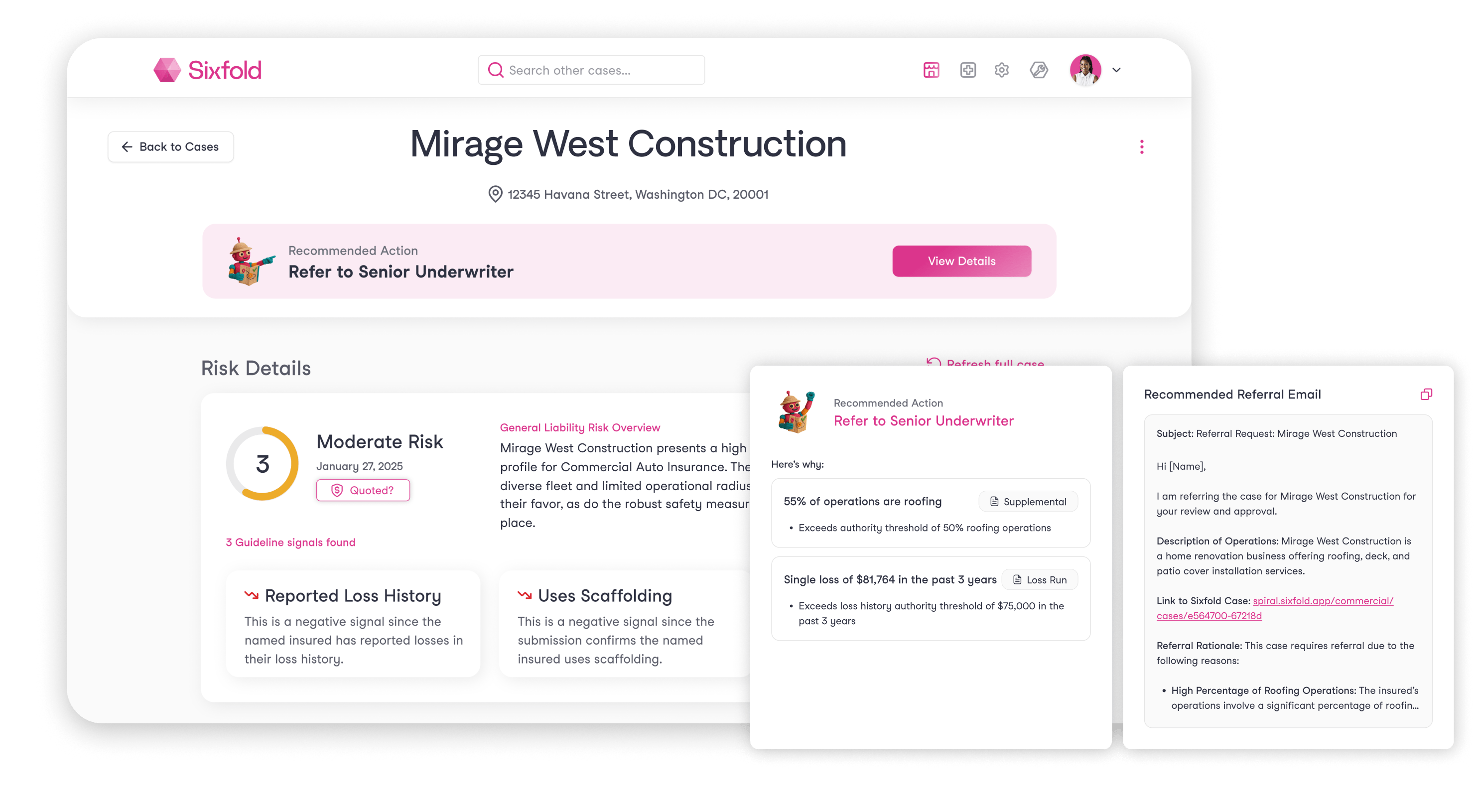

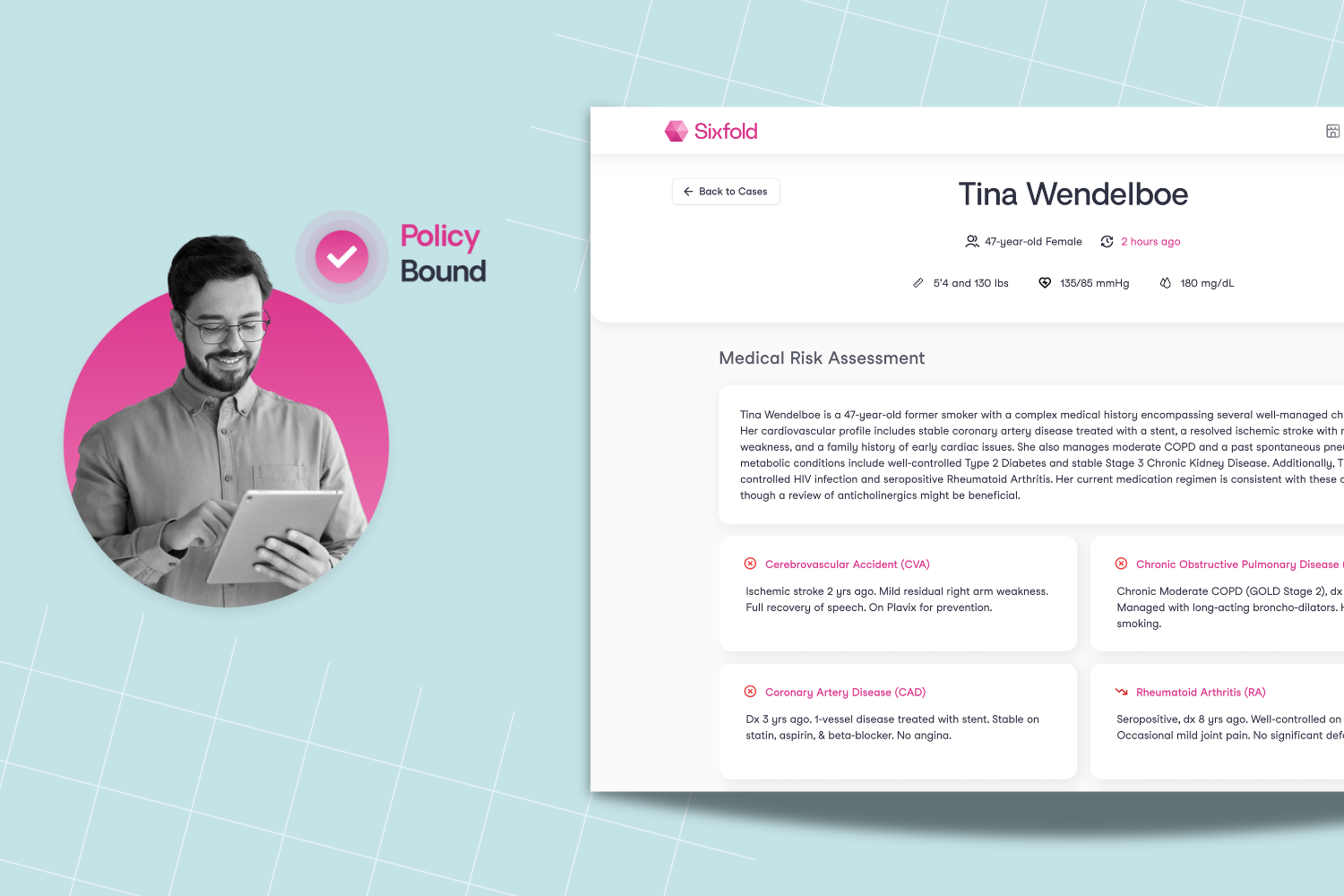

Automate workflows for underwriters

Sixfold spots patterns from a wide array of sources that previously required a human to synthesize. We then use generative AI to summarize risk in insurer’s underwriting format.

Provide traceability of all underwriting decisions

Sixfold provides full sourcing and lineage of all underwriting decisions. No black box, everything is transparent.

Trace your inputs and outputs

No co-mingling of data

Enterprise grade security

Provide traceability of all underwriting decisions

Sixfold provides full sourcing and lineage of all underwriting decisions. No black box, everything is transparent.

Trace your inputs and outputs

No co-mingling of data

Enterprise grade security

Want to Learn More? Schedule a Demo

.png)

.png)

.png)